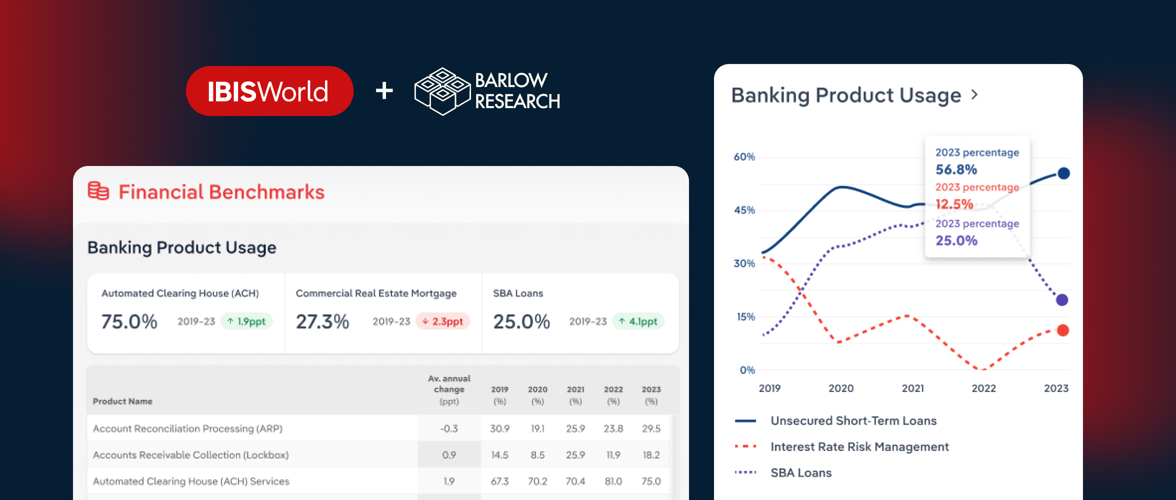

IBISWorld has integrated Barlow Research’s industry-leading banking statistics into its extensive industry research collection, giving banks and credit unions access to detailed Banking Product Usage data across more than 1,400 industries.

With this new dataset, bankers, relationship managers, and frontline teams can see beyond traditional commercial loans and mortgages to understand the full range of financial products businesses rely on. Whether it is equipment leasing, cash flow management tools, or M&A advisory services, this intelligence helps banks offer more strategic, data-backed recommendations.

Empowering banks with deeper market insights

This enhancement reflects our ongoing commitment to equipping banking professionals with actionable, industry-specific insights. With data spanning five years, banking teams can:

- Track long-term trends in product adoption and demand

- Spot emerging opportunities and shifts in customer preferences

- Tailor product recommendations to meet the real needs of business clients

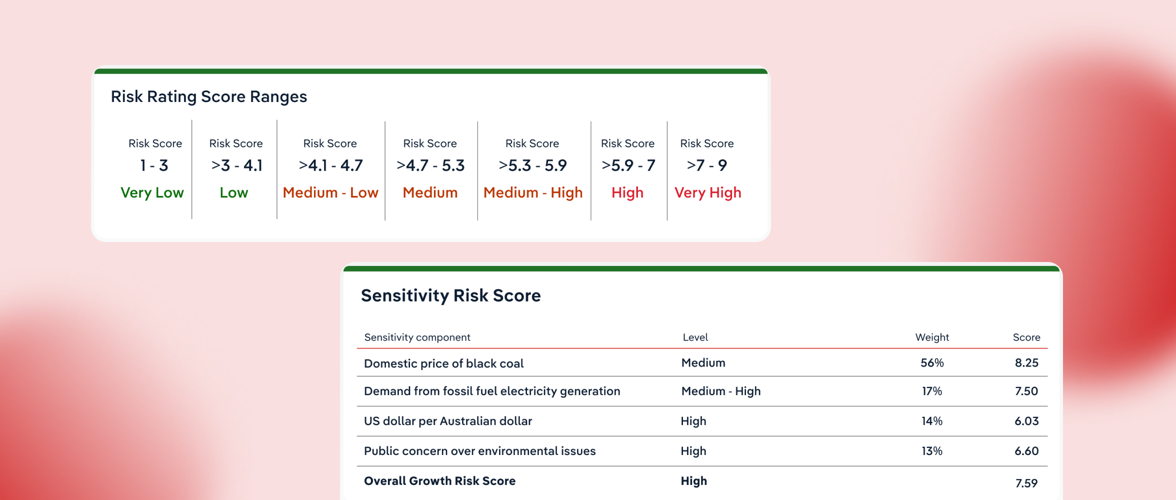

- Strengthen risk assessment strategies by identifying industry-specific financial behaviors

“Bankers today need more than surface-level insights,” explains Matt Murphy, SVP of Client Services at IBISWorld. “By pairing Barlow’s detailed product usage data with IBISWorld’s market intelligence, we are enabling banking teams to predict customer needs, refine strategies, and deliver value that exceeds client expectations.”

What’s in the Banking Product Usage dataset?

This dataset tracks 25 essential banking products that businesses use to keep their operations running smoothly, including:

- Business checking and treasury management

- Equipment leasing and business credit cards

- Lines of credit, trade finance, and payroll services

- M&A advisory and investment management

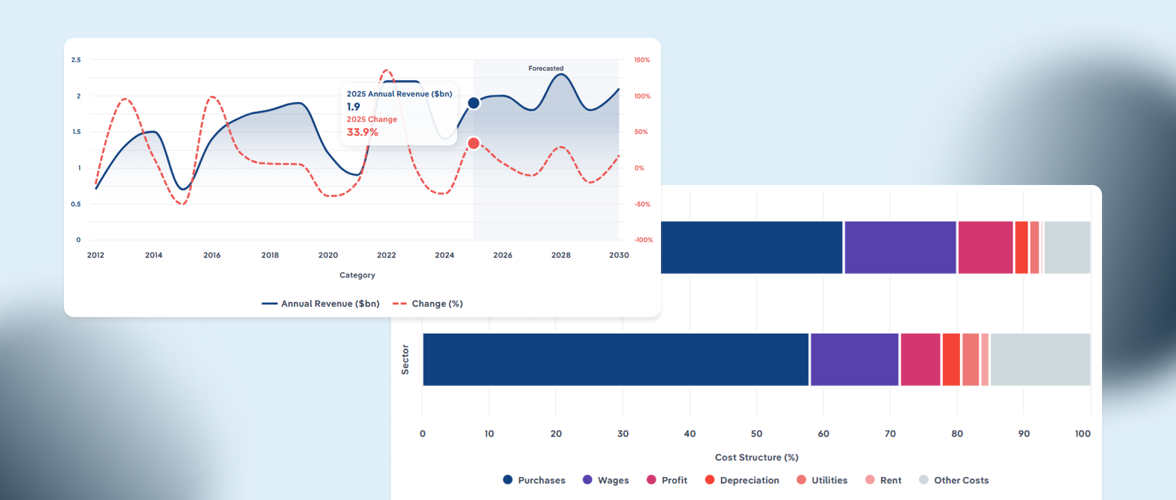

Unlike other data providers, IBISWorld offers a five-year historical perspective. This allows relationship managers and business development teams to spot trends, anticipate shifts in demand, and position themselves ahead of the competition.

Why this data matters in today’s banking landscape

The financial sector is navigating higher interest rates, tighter lending conditions, and increased competition. Now more than ever, understanding customer needs at an industry level is critical for success.

Here is how IBISWorld’s expanded dataset helps:

-

Pinpoint high-demand products to tailor offerings and refine go-to-market strategies. IBISWorld’s expanded dataset reveals which banking solutions resonate in each sector, enabling you to focus resources effectively and strengthen relationships.

-

Engage clients with data-backed recommendations that build trust and credibility. Real-world insights prove your advice is rooted in solid evidence, boosting client confidence and fostering long-term, profitable partnerships.

-

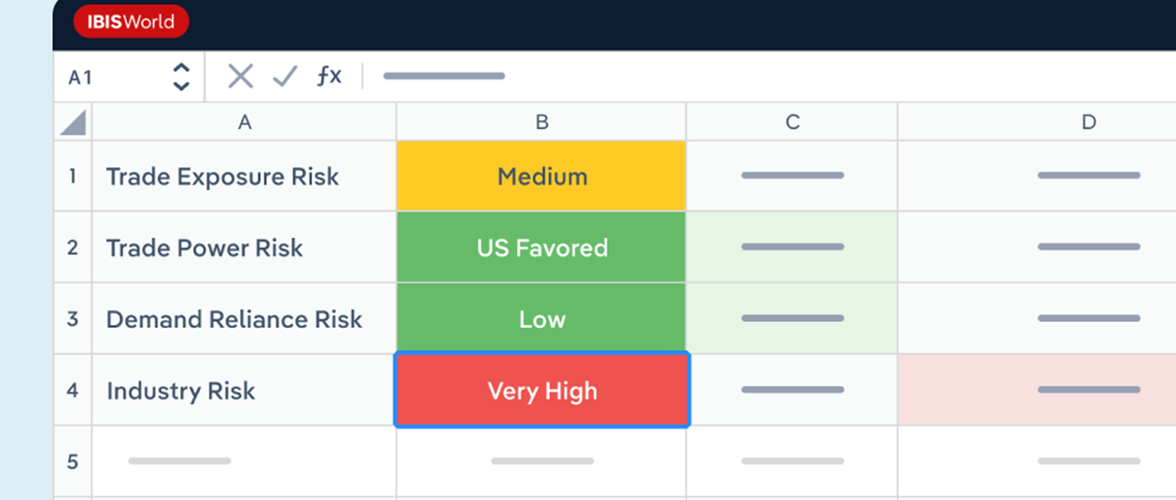

Enhance risk management by assessing industry-specific financial behaviors. Analyzing industries’ reliance on specific products can help you uncover vulnerabilities unique to each sector, so you can make informed lending decisions and mitigate risk proactively.

-

Support long-term strategic planning with insights into product adoption trends. IBISWorld’s five-year dataset reveals shifting patterns, helping you anticipate emerging opportunities and shape forward-looking strategies.

-

Accelerate staff onboarding by providing industry-specific banking insights. Streamlined training prepares new team members to deliver confident, data-backed advice, ensuring a positive client experience from day one.

“Business decision-makers, especially prospective clients, want more than a pre-written pitch,” says Josh Morozowski, IBISWorld’s Director of Product Growth & Integration. “They are looking for advice backed by data that proves you understand their business and industry. That is exactly what this integration delivers.”

Unlock competitive advantages with IBISWorld and Barlow Research

By combining IBISWorld’s industry expertise with Barlow’s banking product insights, banks can offer a more consultative approach. Rather than presenting generic services, they can deliver solutions that businesses genuinely need.

“For too long, banking teams have had to rely on disconnected data sources to glean insights,” adds Joel Mueller, Managing Partner and Research Director at Barlow Research. “In bringing Barlow on board, IBISWorld users can now prepare for meetings more effectively and seize opportunities faster—all from a single platform.”

Start exploring today

If your bank already uses IBISWorld, then accessing this new dataset is straightforward. Visit the Financial Benchmarks chapter in any Industry Report, or check the Industry at a Glance section for a quick snapshot.

About Barlow Research

Since 1980, Barlow Research has provided in-depth market analysis and actionable insights tailored to the commercial financial services industry. Its mission is to deliver the research financial professionals need to create data-backed, customer-centric strategies.