Key Takeaways

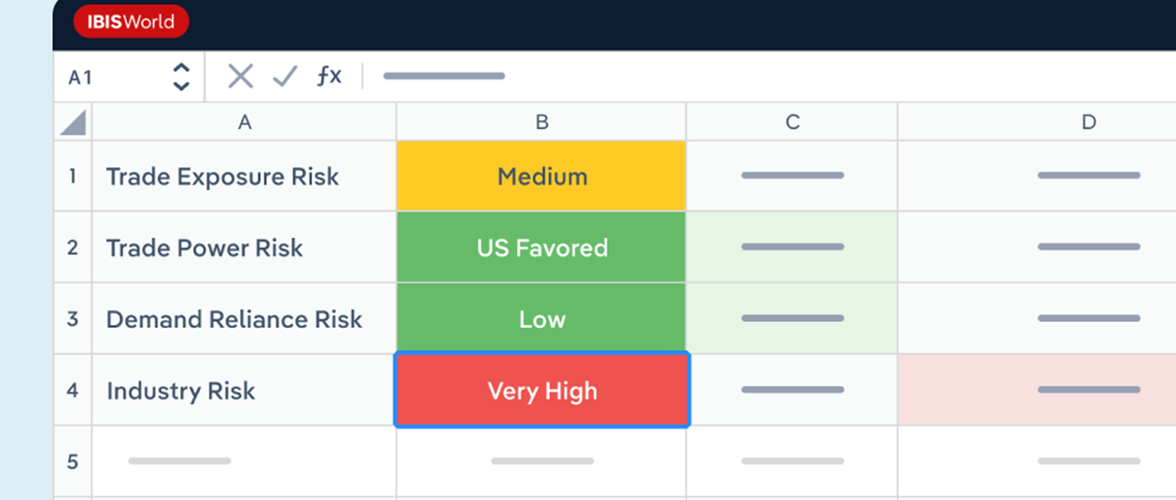

- Trump’s revived China tariffs could distort global pricing and demand, forcing Australian exporters and manufacturers to adapt to more volatile trade and input cost environments.

- Slower Chinese industrial output may hit Australia’s mining, machinery and construction-linked sectors, weakening export demand and delaying investment decisions across key markets.

- As global firms accelerate friend-shoring and China-plus-one strategies, Australian industries may need to re-evaluate supply chain resilience and shift towards new trade partners.

President Donald Trump’s return to the White House has reignited a protectionist trade agenda, with sweeping new tariffs aimed squarely at China. In early April 2025, the U.S. imposed a 145% tariff on all Chinese imports, indicating that additional levies could follow. Framed as a move to defend American jobs and revive local manufacturing, the tariffs signal a sharp escalation in global trade tensions, and their impact won’t be confined to the U.S. and China.

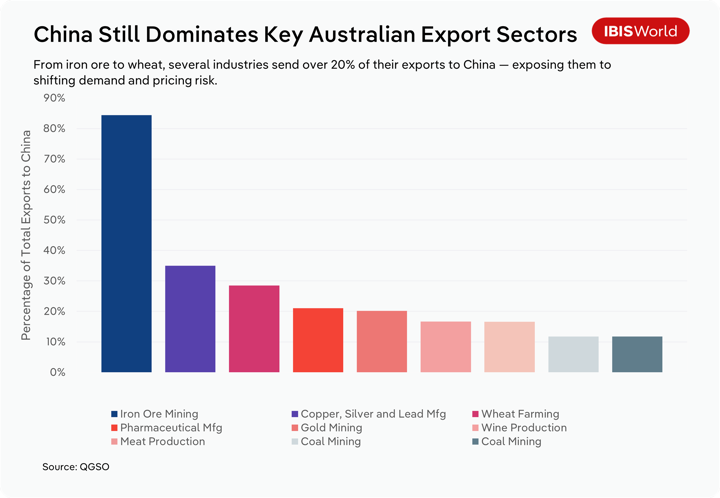

For Australia, the risk lies not in direct retaliation, but in the flow-on effects across demand, pricing and supply chains. China is central to Australia’s export engine as the world's second-largest economy. It buys more than one-third of Australia’s total goods exports, from iron ore to beef to lithium. Disruption to Chinese industrial output, falling export volumes, or shifts in global pricing could compress margins, delay investment and upend demand across exposed sectors.

If China responds with new rounds of stimulus or sourcing shifts, the ripple effects may alter regional competitiveness across the region. For businesses, the stakes are high: understanding exposure, modelling scenarios and staying agile will be key to navigating the months ahead.

Trump’s tariff policy in 2025: A recap of key moves

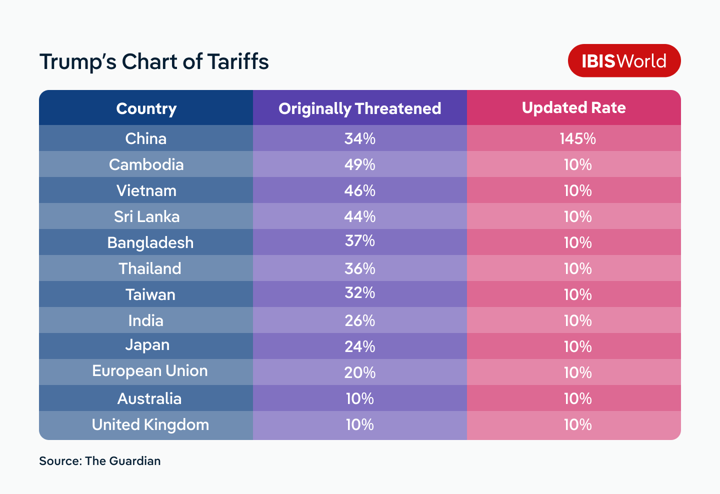

In February 2025, President Trump’s administration imposed a blanket 10% tariff on all Chinese imports, signalling a new chapter in U.S.-China trade relations. This measure aimed to reduce the U.S. trade deficit and boost local manufacturing. Tariffs on specific goods like electric vehicles, green energy components and steel products have been proposed, escalating trade tensions between the two nations.

These new tariffs mirror the aggressive stance taken during Trump’s first term, though the rate and breadth have expanded significantly in 2025, with Chinese goods subject to a 145% tariff.

Beyond China, Trump’s 2025 trade policy targets a wide swathe of countries, with tariffs announced on imports from over 60 nations—including Vietnam, Cambodia, India and Japan. The administration is pursuing a broader effort to address perceived trade imbalances, with proposed tariff rates varying by country and sector.

However, in a key development, the White House has announced a 90-day pause on the blanket 10% tariff for most countries, following pushback from U.S. business groups and trade allies. While this delay offers a temporary reprieve, uncertainty remains high, and affected nations, Australia included, are bracing for further disruption depending on the outcome of the review period. The U.S. is also considering investment restrictions and sanctions on Chinese companies, especially in sectors related to technology and national security.

In retaliation to President Trump's imposition of a 145% tariff on Chinese imports, China has increased its tariffs on U.S. goods from 84% to 125%. Additionally, Chinese exporters are reportedly reducing prices to remain competitive and are actively seeking to redirect exports to alternative markets. The Chinese government may also deploy fiscal stimulus to support industries impacted by these escalating trade measures, ensuring economic stability despite the tariffs.

China’s economic exposure and global trade disruption

China's economy is under increasing pressure due to the escalating U.S. tariffs. In early 2025, China’s export growth slowed to just 2.3% year-on-year for the first two months, a sharp drop from the 10.7% growth recorded in December 2024, highlighting a significant loss of momentum as trade tensions escalate. This deceleration threatens China's industrial sector, potentially reducing production in key manufacturing areas. As tariffs continue to bite, China's exports face substantial headwinds and industrial growth could be stifled. Global demand shifts and oversupply issues could distort pricing, putting strain on international trade.

Multinational companies are now reassessing their reliance on Chinese manufacturing. More and more businesses are turning to "China-plus-one" or "friend-shoring" strategies, diversifying their supply chains to alternative markets like India, Vietnam and Mexico. This shift is not just about finding less costly production; it's about mitigating the risk of an overdependence on China as it navigates growing economic turbulence.

As China redirects production and trade relationships, it may flood new export markets with surplus goods, driving down prices and eroding margins for rival producers. Australian exporters, especially in agriculture, mining and high-tech manufacturing, could be undercut by Chinese alternatives or displaced by suppliers in lower-cost countries benefiting from trade diversion. The structural repositioning of supply chains may also limit access to key intermediate inputs, raising costs for Australian enterprises that rely on globally integrated production.

What this means for Australian industries

Trade tensions may feel like a distant diplomatic issue, but for Australian industries, the consequences are anything but abstract. From commodity exporters to consumer goods manufacturers, global pricing shifts and supply chain realignments could reshape demand, margin pressures and competitive positioning. Understanding where vulnerabilities lie, and how to respond, will be key to maintaining resilience as the trade landscape continues to evolve.

Exporters to China

Australia’s deep trade ties with China have powered growth across key export sectors, but they also heighten vulnerability. If U.S. tariffs slow China’s economy or shift its import mix, Australian exporters may face demand volatility.

Mining and agriculture, particularly iron ore, lithium, beef and barley, are especially exposed. In 2020, for example, China imposed an 80.5% tariff on Australian barley amid diplomatic tensions after Australia called for an inquiry into the origins of COVID-19. The tariffs effectively halted Australian barley exports to China, forcing growers to find alternative markets such as Saudi Arabia at discounted prices.

This illustrated how trade can be weaponised in geopolitical disputes, a risk that looms again as rising U.S. tariffs could prompt Beijing to retaliate economically against aligned trade partners like Australia. To prepare, businesses should diversify markets, monitor demand signals, build supply chain flexibility and scenario-test revenue exposures.

Diversify export markets

Don’t wait for demand shocks to hit. Start broadening your customer base across Asia, the Middle East and Latin America. Fast-growing economies like India, Vietnam and Indonesia are strengthening import capacity and trade relationships, offering realistic alternatives to China. Tailoring products and logistics to suit new markets will take time, so early investment is key.

Move up the value chain

Relying on raw commodity exports exposes businesses to price fluctuations and shifting buyer power. Investing in downstream processing, branding or specialty product development can improve margins, create customer stickiness and reduce vulnerability to geopolitical decisions made outside your control.

Lock in revenue with hedging and contracts

Use tools like futures contracts, foreign exchange (FX) hedging and long-term offtake agreements to create more revenue certainty. These instruments are especially useful for businesses exposed to commodity price swings or exchange rate shifts, helping you maintain stability even when demand patterns change.

Model your exposure and test for shocks

Scenario-test your supply chain and revenue exposure under different China demand outcomes—such as a 10% drop in iron ore orders or rerouted global freight corridors. Use industry data and operational modelling to adjust sourcing, logistics and pricing strategies before you're forced to react.

Import-sensitive sectors

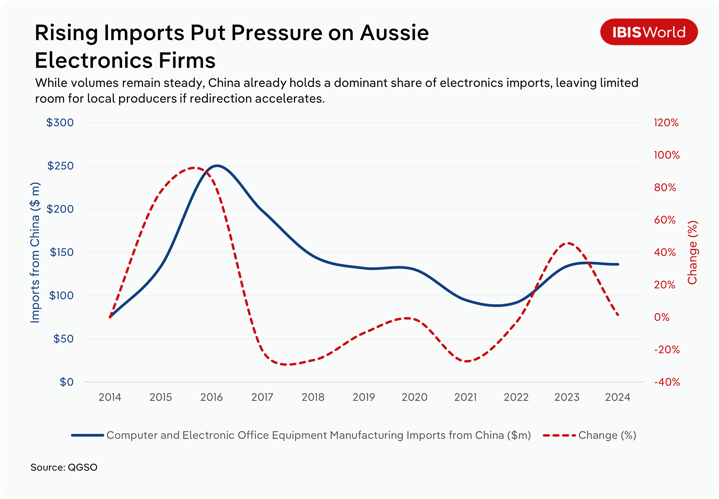

Australian manufacturers could be caught in the crossfire as trade flows shift. With the U.S. market closing off to Chinese exports, there’s a real risk that Australia becomes the next stop for excess inventory—particularly in import-sensitive sectors like textiles, electronics and household goods. If China redirects products originally bound for the U.S., Australian firms may struggle to compete on price, especially where local producers already operate on slim margins.

These risks are particularly acute for manufacturers that compete primarily on price or rely heavily on domestic demand. To manage exposure and build resilience, business leaders should consider the following strategies:

Invest in niche or premium positioning

Competing directly on price with Chinese goods is often a losing battle. Focusing on product differentiation, Australian-made quality, or sustainability credentials can help protect market share. For example, textile manufacturers might pivot to ethically sourced fibres or custom design services, while electronics producers could emphasise cybersecurity, local warranty support, or integration with domestic systems. These approaches can help shift the basis of competition away from cost and toward trust, service, or innovation.

Strengthen supply chain intelligence

Keeping close tabs on Chinese export trends and freight movements will allow manufacturers to anticipate market shifts and respond before they hit. For instance, if textile volumes to the U.S. start falling, local firms can pre-empt potential price pressure in Australia. Investing in real-time analytics or subscribing to export-monitoring tools can sharpen responsiveness and support more proactive inventory and pricing decisions.

Diversify sourcing and production

As multinationals reduce their reliance on China, Australian firms have an opportunity to follow suit. Exploring suppliers in Southeast Asia or Mexico, or relocating parts of production to regional partners like New Zealand or Indonesia, can reduce exposure to trade shocks. Even partial reshoring of assembly or packaging can offer added flexibility, faster turnaround and a marketing edge for “locally finished” products.

Collaborate with policymakers

Industry bodies should advocate for trade remedies or safeguard measures if import surges threaten local industries—particularly in vulnerable segments like textiles and light manufacturing. By monitoring volumes and sharing early indicators of market disruption, businesses can help build the case for anti-dumping actions, tariff adjustments or emergency reviews. Close collaboration also helps firms stay informed about upcoming trade consultations, government support schemes or bilateral negotiations that could affect competitiveness.

Supply chain repositioning

Australia isn’t just vulnerable to global trade disruption—it also has an opportunity to benefit. As multinationals look to diversify away from China, many are adopting "China-plus-one" strategies or shifting production closer to key markets. Australia’s reputation for political stability, high-quality standards and proximity to Asia positions it as a strong contender for advanced manufacturing, logistics and supply chain services.

But to attract new investment and integration into these reshaped supply chains, Australian businesses need to proactively signal their readiness. That means strengthening capabilities and aligning with the resilience priorities of global firms.

Position for nearshoring demand

Invest in automation, quality assurance systems and scalable production capacity to appeal to firms seeking a reliable, low-risk base for regional manufacturing. Highlighting local credentials—such as traceability, ESG compliance or high-skilled labour—can further differentiate Australian suppliers from low-cost alternatives.

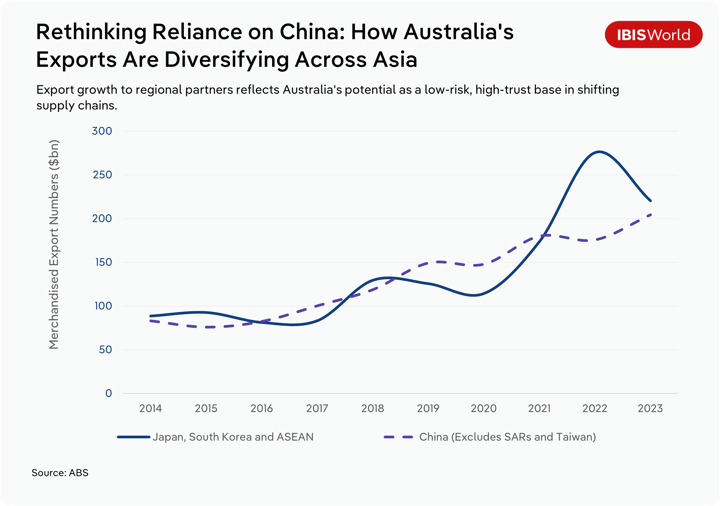

Leverage free trade agreements (FTAs) and regional trade ties

Australia’s extensive network of free trade agreements—particularly with ASEAN, Japan and South Korea—offers businesses a competitive advantage. Use these agreements to pitch Australia as a gateway to the Indo-Pacific, where goods can be efficiently produced, assembled or transhipped with minimal trade barriers.

Strengthen capability in supply chain services

Companies in logistics, warehousing, and transport should look to expand value-added services that support increasingly complex, decentralised supply chains. This might include temperature-controlled storage, just-in-time inventory models or integrated customs and compliance support for regional distribution.

Align with reshoring and resilience trends

Collaborate with policymakers to position Australia as a secure base for critical industries. Sectors like medical supplies, defence, clean tech and semiconductors are likely to attract public and private investment under broader supply chain resilience strategies—particularly where geopolitical risk is a concern.

Price volatility and procurement risk

As tariff policies shift and trade flows reconfigure, Australian businesses face a growing risk of price instability and supply uncertainty—particularly for goods with complex global inputs or high import dependency. The ripple effects of U.S. tariffs on China could affect everything from raw material costs to lead times, especially if demand bottlenecks or inventory gluts emerge in other parts of the world.

Use flexible procurement contracts

Incorporate clauses for variable pricing, hedging against currency or commodity swings, and shorter contract durations that allow faster renegotiation in volatile markets. This flexibility can help businesses adapt quickly to shifting cost structures.

Invest in supply chain visibility tools

Digital platforms that track real-time inventory, shipping timelines and upstream risks can dramatically improve responsiveness. Tools that integrate demand forecasting and supplier health monitoring can also help procurement leaders make informed decisions under pressure.

Build inventory buffers selectively

Where practical, maintain strategic reserves of high-risk inputs—such as electronic components or specialised machinery parts—with long lead times or price sensitivity. But be mindful of storage costs and obsolescence risk when deciding where and how much to stockpile.

Utilise industry data

Accessing industry benchmarks and supply chain trend data can help procurement teams anticipate pricing shifts, identify emerging risks and make more confident sourcing decisions. Sector-specific insights into input cost volatility, demand outlooks and trade exposure allow for more targeted mitigation strategies and better supplier negotiations.

Final Word

Australia may not be the direct target of Trump’s renewed tariff agenda, but it won’t escape the fallout. The indirect effects could be even more significant, especially those playing out through China. As Beijing grapples with rising trade pressure, a potential slowdown or redirection of its industrial activity could reshape demand for Australian exports and flood some domestic markets with cheaper imports.

Shifting trade flows, pricing distortions and supply chain uncertainty could affect mining, agriculture, manufacturing and retail. The pace and scale of disruption will depend on how deeply US-China tensions escalate and how China chooses to respond.

Businesses must assess where they're most exposed, stress-test their assumptions about growth and costs and adapt sourcing or investment strategies where necessary. Understanding the sector-level risks is critical to staying agile and turning disruption into a competitive edge.