Key Takeaways

- The US and China have engaged in a dramatic tariff escalation, with Beijing raising levies, imposing export bans and restricting American companies’ access to its market.

- China’s sweeping retaliatory tariffs have made US agricultural products far less competitive abroad, threatening billions in exports and pushing farmers to find new markets and plead for government aid.

- The North American auto supply chain also threatens to unravel as Canada goes blow for blow on duties, raising costs for manufacturers, wholesalers, retailers and consumers alike.

At the outset of the second Trump presidency, the United States has drastically intensified its use of tariffs, reshuffling a global trade order that generated a record $33 trillion in 2024. Tariff policy has been aggressive but fast-changing, with President Trump frequently reversing course and pausing some of his most sweeping actions. Nonetheless, current policies, if left unchanged, would push levies on imports to their highest rates in a century.

The Trump administration’s tariff actions began with the introduction of broad 25% tariffs on aluminum and steel, later expanded to automobiles and auto parts. On April 2, President Trump announced an even more expansive “reciprocal tariffs” regime, applying tariffs of up to 50% on imports from countries with which the United States had a trade deficit, as well as a universal 10% tariff on most other imports.

While President Trump announced a 90-day pause on all reciprocal tariffs just one week later, many of his previous levies remain in place. And while the United States two largest trade partners, Canada and Mexico, have been offered a temporary reprieve from most tariffs for goods covered by the United States-Mexico-Canada Agreement (USMCA) agreement, China has faced by far the strictest actions, with duties on imports climbing to 245%.

America’s trade partners have taken different approaches in response to the imposition of import duties. While some partners have moved in concert with US levies and others have taken a wait and see approach, China, most notably, has responded with tit-for-tat retaliatory measures against American-made goods. These responses have significant implications for American industries, affecting both the short-term outlook of many businesses and how these businesses will plan to adapt their long-term strategy in this uncertain environment.

Mapping the global fallout from US tariff hikes

The United States’ tariff escalation has prompted sweeping retaliatory actions from key trading partners. In response to the Trump administration’s reciprocal tariff regime, China initially enacted a 34% reciprocal tariff on all American imports and quickly escalated its response as the US raised its own tariffs. Within days, China increased its tariffs on US goods to 84%, then to 125%, directly matching and amplifying each new round of US measures.

China’s response has extended well beyond tariff hikes. Beijing has banned exports of critical minerals, added American companies to its “unreliable entity list,” restricting their access to the Chinese market, and has initiated anti-dumping investigations on American products. This includes a recent inquiry into whether certain medical devices, such as X-ray tubes used in computed tomography machines, were exported at a lower price than their normal value. Medtech companies like GE Healthcare, which relies heavily on its imaging segment in China, could be affected. The investigation came just days after President Donald Trump raised tariffs on imports from China by 34%, further fueling speculation about whether this is part of a broader retaliatory effort.

America’s North American trading partners, Mexico and Canada, have taken widely different approaches in response to President Trump’s tariffs. While Mexico announced its intention to impose retaliatory levies on the United States, it has, to date, not done so. Canada, however, has responded with a broad range of tariffs in direct retaliation for American duties on Canadian products. Presently, Canada has imposed 25% tariffs on a range of goods imported from the United States, including reciprocal tariffs on steel and aluminum and products non-compliant with USMCA.

The European Union, meanwhile, reacted with a two-phase plan for retaliatory tariffs on a broad set of US goods including agriculture, steel, aluminum and consumer products. However, following President Trump’s announcement of a 90-day suspension of some US tariffs, the EU paused the implementation of its own retaliatory tariffs for the same period. Regardless, the actions taken by the United States and China alone, the world’s largest importer and exporter respectively, threaten to disrupt business globally.

Cross-border automotive manufacturing faces tariff challenges

American auto manufacturing is in many ways a misnomer. Since the enaction of the North American Free Trade Agreement (NAFTA), the sector has operated as an integrated North American supply chain encompassing the US, Canada and Mexico, with extensive cross-border supply chains. Car manufacturers thus face significant headwinds from retaliatory tariffs imposed by Canada in response to US levies.

Canada is the largest foreign market for cars and buses manufactured in the United States, with nearly $25 billion and $7 billion worth of finished goods, respectively, expected to be shipped to the north. Canada’s tariff response as of April 9 slaps a 25% tariff on non-USMCA compliant fully assembled vehicles imported from the United States. This measure also extends to the non-Canadian and non-Mexican content of USMCA-compliant vehicles, directly increasing costs for American automakers exporting to Canada. Indicative of how intertwined the North American auto supply chain is, Canada is also the largest export market for auto engines, electronics, interiors and general parts, and second only to Mexico for brakes, steering and suspension and metal stamping.

Although few American-made vehicles are destined for China, the country’s steep retaliatory tariffs are likely to further raise costs for manufacturers. China’s export controls on critical minerals and high-tech components essential for electric vehicles and advanced automotive electronics are likely to disrupt supply chains further, only raising costs for final vehicles further. The Center for Automotive Research forecasts that the cumulative impact of tariffs could increase costs $107.7 billion for American automakers, with Detroit’s Big Three alone absorbing nearly $42 billion.

Domestic industry response

Since April 2025, American automakers have responded by rapidly increasing cross-border imports of vehicles and parts to circumvent tariffs. They have accelerated shipments from Mexico, Canada and overseas suppliers, while delaying or adjusting production schedules. However, the highly complex, interwoven supply chains of vehicle manufacturers give companies few options for quickly adjusting to levies. Instead, the sector is urging President Trump for a carve-out from the tariffs and seeking exemptions on auto parts, with Canada promising to remove its reciprocal levies in response.

Strategies for success

- Tariff Engineering: Focus on adjusting product designs or altering the mix of domestic and foreign parts to comply with USMCA and avoid the 25% tariffs on non-compliant vehicles.

- Strategic Inventory Stockpiling: Build up inventories of high-demand parts and finished vehicles in anticipation of future tariff increases.

- R&D for Alternative Materials: Invest in research and development to identify and implement alternative materials that can be sourced locally or at lower tariff rates, particularly for components such as electronics and high-tech parts for electric vehicles (EVs).

U.S. aerospace manufacturing faces headwinds from Chinese tariffs

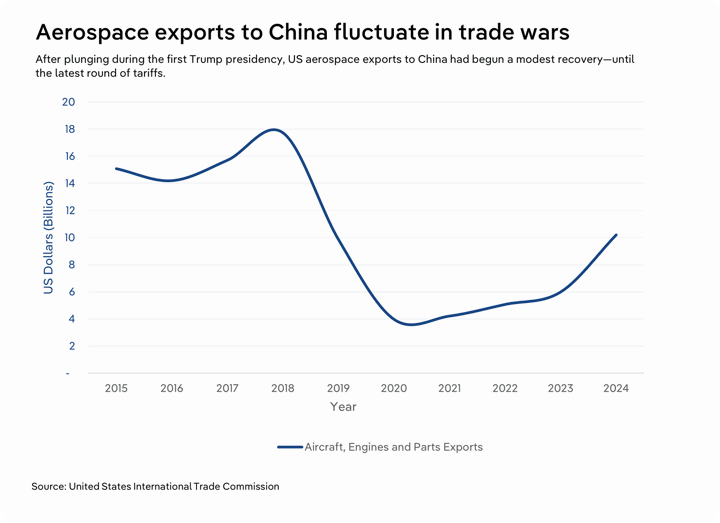

China’s retaliatory tariffs are already disrupting business for American aircraft manufacturers. With China imposing a 125% tariff on US-made aircraft and parts, the cost of American planes in the Chinese market has more than doubled, making them unaffordable for Chinese carriers. As of April 15, China has also ordered its airlines to halt deliveries of all Boeing jets as a direct response to further retaliatory levies put in place by the Trump administration. This has led to the cancellation of planned deliveries for dozens of Boeing jets, with 10 Boeing 737 Max aircraft on the verge of entering Chinese fleets. For the largest American aircraft manufacturer, the move severely imperils its export revenues and threatens its long-term access to the world’s second-largest aviation market.

Beyond aircraft sales, China’s export restrictions on critical materials—especially medium and heavy rare earth elements—pose additional challenges for aerospace production, including space vehicles and missiles. These minerals are essential for manufacturing jet engines, radar systems, avionics and high-temperature magnets used in both commercial and military aircraft. Since the US relies heavily on China for these materials, the new export controls are all but certain to increase costs for American manufacturers, and will delay production as supply chains are disrupted. The move creates a fundamental risk for defense contractors like Lockheed Martin, which is forecast to generate more than $30 billion in domestic aerospace manufacturing revenue in 2025, imperiling its ability to deliver F-35 fighter jets and advanced missile systems.

Domestic industry response

American aerospace manufacturers will increase the speed at which they look to diversify their sources for rare earth minerals. In addition to looking for exploring partnerships with other international producers, companies can look to partner on projects with domestic mineral producers’, like MP Materials' Mountain Pass mine. However, as the only active rare earth mine and processing facility, the Mountain Pass mine simply won’t be able to meet total manufacturing need. American companies imported more than $2.4 billion in minerals and phosphates in 2024, accounting for more than a quarter of domestic demand.

Strategies for success

- Diversify Rare Earth Sourcing: Actively invest in alternative sources for rare earth minerals by forging partnerships with other global suppliers, such as those in Australia or Canada.

- Accelerate Production of Non-China Dependent Aircraft Models: Shift production focus toward aircraft models or parts that are less likely to be impacted by Chinese tariffs or restrictions, ensuring continued sales to global markets and avoiding reliance on China as a key buyer.

- Increase Domestic Production of High-Value Parts: Invest in high-value parts manufacturing, such as specialized jet engine components and avionics, to reduce dependence on foreign imports and ensure resilience in supply chains.

- Shift Production for Military Contracts: In response to tariff pressures, consider reorienting production lines toward military contracts, which may be less affected by international tariff disputes.

Agriculture strains against escalating trade disputes

China’s retaliatory tariffs are hitting a broad swath of American agricultural exporters, sharply raising the cost of goods in the Chinese market. In March, China imposed a 15% tariff on products like chicken, wheat, corn and cotton, and a 10% tariff on soybeans, sorghum, pork, beef, seafood, fruit, vegetables and dairy. China’s imposition of 125% reciprocal tariffs in April come on top of these previously installed levies. These measures have made American agricultural products significantly less competitive in China overnight.

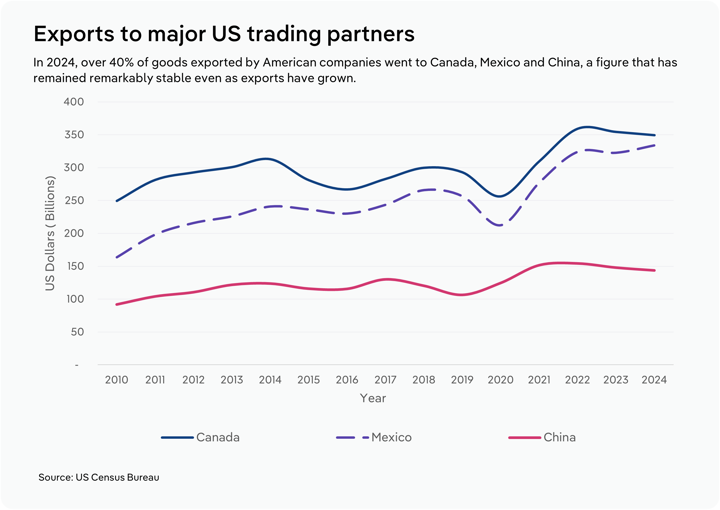

China is the third-largest importer of American farm goods, behind Mexico and Canada, and loss of competitiveness in the Chinese market will be a huge hit for American farmers. In 2024, soybean farmers sent $16.7 billion worth of product to China, making it far and away the largest market for an industry projected to eclipse $56 billion in sales in 2025. The American Soybean Association estimates that soybean producers alone could lose nearly $6 billion annually because of tariffs. Retaliatory tariffs during the first Trump administration cost agricultural exporters more than $27 billion, with China accounting for more than 95% of lost revenue.

As a result, American farmers face potential long-term loss of market share to competitors. The losses will be particularly concentrated in the Planes region, where are nearly half of all soybean growers are located. Illinois alone accounts for 13.9% of all farms, followed closely by Iowa at 12.9%. Kansas and Texas’ sorghum growers will also be hard hit, with nearly 90% of exports previously destined for China.

Domestic industry response

American farmers find themselves in a more challenging position than during the previous trade war between the United States and China, saddled with far greater duties. To offset lost exports to China, farmers are looking to redirect crops like sorghum and soybeans into higher-value products, like domestic ethanol production and livestock feed. Growers will also look to open to new export markets, with the USDA announcing the launch of new agricultural trade promotion programs and opening applications for four export market development programs. Farmers in hard-hit states will look to benefit from the Trump administration’s blitz to promote agricultural exports in new markets, with the USGA secretary planning trips to Vietnam, Japan, India, Peru, Brazil and the United Kingdom in the next six months.

The fate of agricultural producers may ultimately rest on the availability of government support to help cushion the impact of the tariffs. The USDA announced in March that it would expedite $10 billion in direct economic assistance to agricultural producers under the American Relief Act, and talks about additional emergency aid are ongoing. This follows a precedent set during the first trade war with China, which lasted from 2018 to 2019 and resulted in billions of dollars of lost revenue for American farmers. To help offset the losses, President Trump handed out $23 billion in subsidies from a fund created by the Department of Agriculture to stabilize the farm sector.

Strategies for success

- Expand Value-Added Processing: Invest in processing facilities to convert raw agricultural goods into value-added products such as packaged foods, oils, or animal feed, which could reduce reliance on raw exports and increase profit margins in domestic and international markets.

- Utilize Government Aid Programs: Take full advantage of USDA’s agricultural trade promotion programs and the $10 billion in economic assistance through the American Relief Act.

- Build Relationships with Emerging Markets: Target emerging economies where agricultural products are in high demand but not yet subject to retaliatory tariffs. Focus efforts on cultivating strong trade relationships and long-term partnerships in markets like Vietnam, India, or parts of Latin America.

Tariffs threaten U.S. Access to China's pharmaceutical market

While Chinese production is crucial to American pharmaceuticals destined for the United States, particularly generic drugs, major American pharmaceutical manufacturers export innovative, brand name drugs to the Chinese market. Major US-based producers including Eli Lilly, AstraZeneca, GSK and Sanofi all operate manufacturing facilities in the United States that supply key drugs solid in China. For example, Eli Lilly, which is expected to generate more than $22.6 billion in domestic brand-name production revenue in 2025, manufactures tirzepatide, a leading diabetes and weight-loss drug sold in China, at its Indiana facility. The imposition of tariffs will make American-made drugs significantly more expensive in China, putting American manufacturers at risk of losing ground to European competitors.

Although China has, not imposed export restrictions targeting pharmaceutical aggregates essential to the production of generic drugs, government agencies have expressed concerns about the potential for such restrictions. On April 1, the Department of Commerce launched an investigation into the national security risks posed by the pharmaceutical ingredients supply chain. To date, domestic generic drug manufacturing remains unaffected by China’s reciprocal tariff actions.

Domestic industry response

American manufacturers of brand-name medicines have few short-term options for relocating production, leaving them with little choice but to absorb higher costs. This will present an immediate challenge to an industry where supply chain woes have already eroded profitability in recent years. However, producers will look to diversify production facilities in the medium-term to maintain unrestricted access to the second-largest pharmaceutical market in the world. And while drug makers have already announced proactive steps to reshore capacity to the United States in anticipation of tariffs, the paramount challenge for producers is still how to reorient supply chains away from China.

Strategies for success

- Focus on High-Value Drugs in Tariff Negotiations: Prioritize lobbying for tariff exemptions or reductions on high-value American brand-name pharmaceuticals, such as diabetes and cancer treatments, to maintain competitive pricing in China.

- Strengthen Relationships with Chinese Regulators: Engage directly with Chinese regulators and industry associations to advocate for favorable tariff policies or carve-outs for essential pharmaceuticals.

- Enhance Intellectual Property Protection: Strengthen IP protections and enforcement in international markets to safeguard U.S. innovations, particularly for new drugs.

Final Word

The sweeping tariffs initiated by the Trump administration have no modern precedent. While many of the harshest measures are currently on pause, the average effective tariff rate on imports into the United States has surged to the highest level in nearly 90 years. The escalation has triggered sweeping retaliation: China has raised tariffs on goods to a staggering 125% among other targeted actions, Canada has imposed sector-specific levies in addition to threatening broad-based duties, and other trade partners are considering similar moves, even as they anxiously hope for a reversal in American policy.

For American companies navigating a global environment with sharply higher costs, short-term options will be limited—increase prices at the risk of losing customers or absorb higher costs at the expense of profit—and painful. Looking ahead, American businesses will need to proactively adapt by reshoring production, diversifying export markets and reconfiguring global supply chains to maintain competitiveness. In a global marketplace beset by restrictions, businesses have no choice but to rethink the way they operate.