Key Takeaways

- Changes to casual employment, gig work and union regulation could reshape compliance, workforce models and retention strategies.

- Competing tax incentives and infrastructure priorities will alter investment timing, cost structures and industry advantage.

- Proposed caps and visa changes may tighten skilled labour pipelines and disrupt sectors reliant on international talent and student demand.

- Shifting homebuyer support and infrastructure funding priorities will influence housing demand, project risk and construction pipelines.

Australia’s largest ever federal election is underway, with record enrolments and growing momentum across key policy debates. The outcome could reset priorities across the economy, shaping everything from labour costs to compliance obligations and investment timelines.

With both major parties pitching markedly different agendas, business leaders and strategic planners face a growing need to assess exposure, pressure-test assumptions and prepare for policy-driven change.

Four core areas - workplace rules, business taxation and investment incentives, migration policies, and housing and infrastructure, carry material implications for cost structures, growth strategies and workplace planning. Regardless of the election outcome, strategic planning at an industry level will be essential to effectively prepare for future developments.

Workplace and employment rules

Labor: Stronger worker protections and expanded obligations

Since coming to power, the Labor Party has implemented reforms to workplace and employment rules, focusing on strengthening workers’ rights and enhancing job security. The Albanese Government rolled out the “Closing Loopholes” legislation, which criminalised wage theft, regulated labour-hire arrangements and implemented “Same Job, Same Pay” laws to ensure labour-hire workers receive equal pay, boosting wages for workers in industries like mining, aviation, warehousing and meat processing.

Labor has also introduced new protections for the gig economy and casual workers, supporting pathways to permanent employment. Industries relying heavily on flexible or casual labour models, like delivery services, hospitality, agriculture and logistics, may face structural changes in workforce planning and remuneration frameworks.

Looking ahead, Labor plans to restrict non-compete clauses for workers earning under $175,000, expand the right to disconnect and introduce real-time superannuation payments each pay cycle.

Other key proposals include a national labour-hire licensing scheme and crackdowns on anti-competitive practices like wage-fixing and no-poach agreements. While these reforms aim to boost fairness and mobility in the workforce, some measures may increase employers' compliance obligations and labour costs and expose firms to penalties for breaches.

Coalition: Prioritising business flexibility and reduced oversight

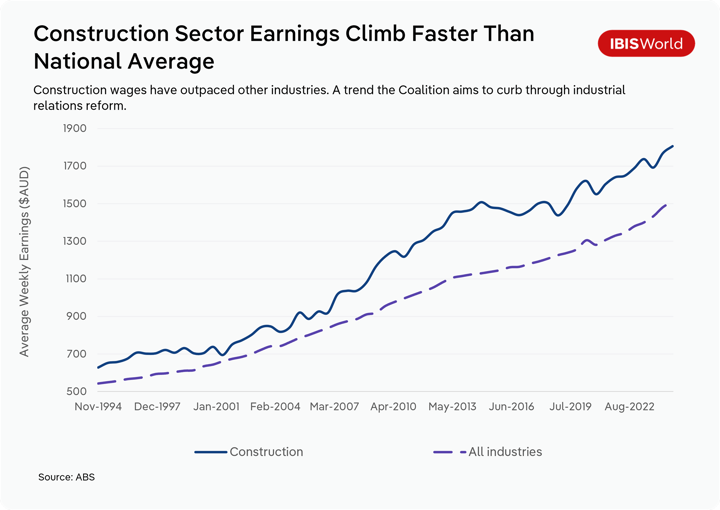

The Coalition’s workplace and employment policy platform centres on reducing regulatory burdens for businesses, restoring employer flexibility and curbing union influence. Key proposals include reinstating the Australian Building and Construction Commission to oversee conduct in the construction sector, introducing US-style anti-racketeering laws and repealing several Labor-introduced reforms like the right to disconnect and the current definition of casual employment.

Instead, the Coalition would move to a simpler definition of casual employment based on the absence of a firm commitment to ongoing work. The party was pushing a return-to-office policy for parts of the public sector; however, it has since abandoned these proposed changes.

While these measures are positioned as productivity-enhancing, reducing compliance pressures and offering relief to employers, critics argue they may dilute worker protections and limit employment stability.

What this means for industry

- Construction, logistics, food delivery, aged care and agriculture face high exposure under Labor’s reforms due to reliance on casual, gig or labour-hire models.

Under a Labor government, businesses operating within these sectors must reassess hiring practices, employee classification models and onboarding workflows to comply with new frameworks. - Tech, consulting and media firms, where flexible work arrangements and non-compete clauses are common, may need to rethink how they retain staff and protect sensitive information, especially in high-turnover or specialised roles, if non-compete clauses are no longer available under Labor’s proposed changes.

- Construction firms stand to benefit from the Coalition’s proposed reinstatement of the Australian Building and Construction Commission (ABCC) and scaled-back union powers, though any gains in productivity must be balanced against the reputational and legal risks of under-regulated employment practices.

- All employers should reassess human resources (HR) systems and contracts in light of changing definitions of casual employment, which could reshape obligations and increase legal risk depending on the election outcome.

Business taxation and investment incentives

Labor’s approach: Targeted investment vs. tax relief

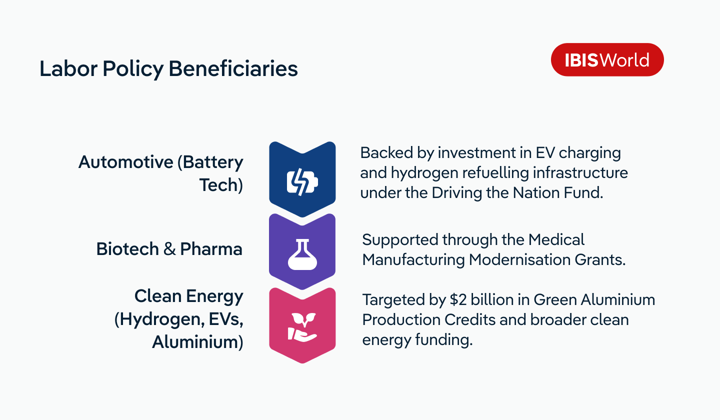

Labor aims to boost domestic production through initiatives like the Medical Manufacturing Modernisation Grants (MMMG), which will enhance the supply chains for essential medical products, benefiting industries like biotech and pharma by reducing import dependency and strengthening local production capabilities.

The party supports the transition to electric vehicles through the Driving the Nation Fund, investing in EV charging and hydrogen refuelling infrastructure while backing battery technology and mining services, creating growth opportunities for the automotive and battery sectors.

They have also extended the $20,000 instant asset write-off for small businesses, providing cashflow support for investment, though this is less generous than the Coalition’s $30,000 write-off. The Green Aluminium Production Credits, a $2 billion investment, aims to help aluminium smelters shift to renewable energy, supporting the clean energy sector.

Coalition’s approach: Broad tax relief and deregulation

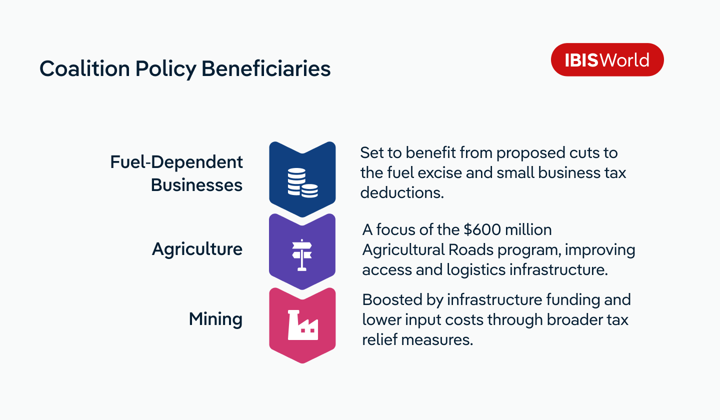

The Coalition's position on business taxation and investment incentives emphasises tax relief, deregulation and targeted infrastructure support for key sectors. They have committed to a $600 million Agricultural and Mining Roads program to improve transportation infrastructure for the agriculture and mining sectors, boosting productivity and market access while also improving logistics companies’ efficiency.

Regarding taxation, the Coalition seeks to lower tax burdens by reintroducing a 23.9% tax-to-GDP cap, promising tax cuts for small businesses and expanding eligibility for reduced corporate tax rates.

The party also proposes halving the fuel excise for a year, reducing operating costs for fuel-dependent industries and consumers, which could lead to improved profitability for sectors like logistics, mining and agriculture. They’re planning tax deductions for small business meal expenses and repealing Labor’s $16 billion tax credits for critical minerals and green hydrogen producers, which could negatively impact industries transitioning to greener energy solutions.

The Coalition argues that reducing taxes and regulatory burdens will foster investment, increase productivity and create jobs, particularly in sectors dealing with rising input costs.

What this means for industry

- Manufacturers, clean energy and advanced tech producers may benefit more under Labor, but should track grant eligibility and the durability of policy support over time.

- Transport, logistics and fuel-dependent industries stand to gain under the Coalition through short-term cost relief—yet should weigh these gains against potential lost momentum in renewables investment.

- Small businesses should review how each party’s asset write-off thresholds and tax treatment will affect upcoming investment plans and cash flow.

- Sectors reliant on clean energy policy, including aluminium smelting, hydrogen and EV infrastructure, need to prepare for policy reversal risk and factor that into long-term scenario planning.

Migration policy and workforce supply

Labor’s approach: Stable intake to support workforce gaps

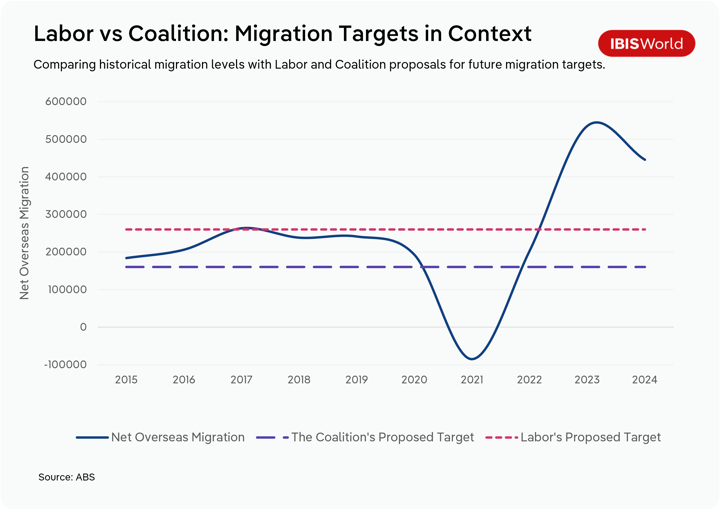

Labor's migration policy emphasises maintaining a stable and consistent migration intake to support economic growth and workforce supply. The Albanese government has set the permanent Migration Program planning level at 185,000 places for 2024–25, aiming to provide steady support for sectors reliant on international talent. Their approach reflects a commitment to balancing migration levels with the capacity of housing and infrastructure systems while sustaining economic growth.

Coalition’s approach: Reduced migration to ease housing pressure

The Coalition's position on migration policy focuses on reducing the number of international students and cutting net overseas migration to ease housing and infrastructure pressures. Opposition Leader Peter Dutton has proposed capping international student commencements at public universities to 115,000 per year, a reduction of at least 30,000 students, to help ease pressure on the housing market amid significant rent increases.

The party aims to triple visa application fees for students at Group of Eight (Go8) universities and introduce a $2,500 fee for students changing education providers. Dutton has also outlined plans to reduce net overseas migration by 100,000 to help manage housing demand and infrastructure challenges.

What this means for industry

- Healthcare, aged care and construction benefit from Labor’s stable migration intake, which supports long-term workforce planning. Under the Coalition, proposed reductions to skilled migration may disrupt recruitment pipelines and increase labour shortages.

- Higher education, particularly Go8 universities, face significant risk under the Coalition’s proposed visa caps and fee hikes, which could reduce international enrolments, trigger revenue loss and constrain course offerings or campus expansion.

- Retail, accommodation and other student-reliant industries may experience a downturn if Coalition migration policies reduce international student numbers and spending.

- Construction and property developers could see upside under the Coalition’s plan to lower net migration, which may ease housing demand pressures and boost affordability—potentially accelerating residential project activity.

Housing and infrastructure commitments

Labor’s approach: Supply-side investment and homebuyer support

Labor’s housing and infrastructure policy aims to improve homeownership access and increase the supply of affordable housing. The party will continue the existing two-year ban on foreign investors and temporary residents buying established homes, consistent with the Coalition's proposed policy.

The party will also expand its Help-to-Buy scheme by broadening income eligibility and increasing the property price cap, allowing more first-home buyers to enter the market with shared equity from the government.

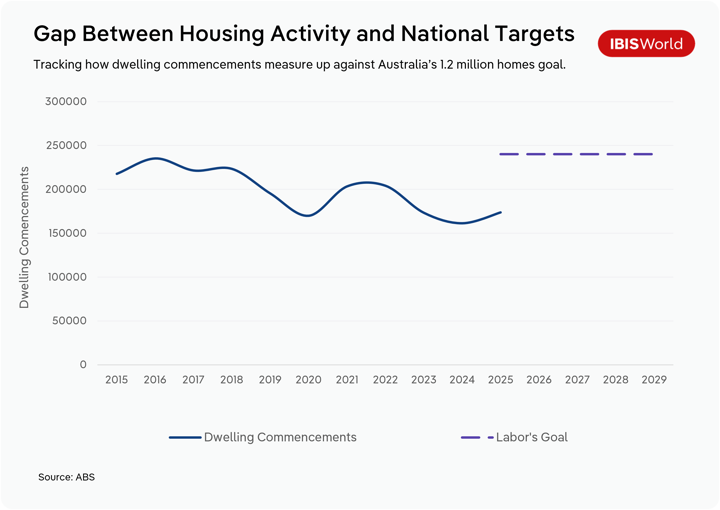

Additionally, Labor will continue deploying funds from its $10 billion Housing Australia Future Fund, which is intended to facilitate the construction of 55,000 social and affordable homes over five years.

Coalition’s approach: Developer certainty and infrastructure acceleration

The Coalition’s housing and infrastructure policy focuses on boosting housing supply and enhancing affordability through regulatory and financial measures. A key proposal is the creation of a $5 billion fund to accelerate the delivery of essential infrastructure at new housing development sites, aiming to deliver 500,000 new homes. The party also plans a 10-year freeze on changes to the National Construction Code to reduce compliance costs and give developers greater certainty.

To support home ownership, the Coalition would allow first-home buyers to access up to $50,000 from their superannuation, with repayment required upon sale of the property. Additionally, the Coalition intends to scrap Labor’s $10 billion Housing Australia Future Fund, citing delays in housing delivery.

What this means for industry

- Construction, property development and civil engineering firms stand to benefit from both parties’ housing supply policies, but the Coalition’s infrastructure fund may generate earlier-stage demand across utilities and site works.

- Affordable and mid-tier housing developers could see heightened demand under Labor’s equity-based Help-to-Buy model, though this may also strain material and labour supply chains.

- Mortgage lenders and financial services should prepare for diverging buyer profiles—Labor’s model reduces initial loan size, while the Coalition’s super-access policy could reshape deposit flows and repayment forecasting.

- Utility providers and building contractors must anticipate demand volatility tied to infrastructure delivery timelines and changing affordability dynamics.

- Developers prioritising compliance and long-term investment may benefit from the Coalition’s construction code freeze, which offers cost predictability—but should also account for potential policy reversals after the election.

- Foreign-focused real estate firms should plan for subdued demand under the ongoing ban on overseas buyers.

Final Word

The outcome of the 2025 Australian federal election will impact various sectors of the economy. Labor’s focus on workforce protections, targeted investment in key industries, and stable migration policies aim to support long-term growth, but may raise compliance and cost burdens. The Coalition’s emphasis on tax relief, deregulation and reduced migration to alleviate housing pressures but risks creating workforce shortages in key industries.

For businesses, the priority is clear: don’t wait and react. Strategic planning and assessing exposure and risks to differing policy agendas will be essential. Particularly in sectors like construction, healthcare, education and technology, where workforce availability, tax policy and regulatory stability directly affect performance.

Whichever party prevails, businesses must continuously reassess their assumptions and prepare for policy shifts that will reshape the landscape over the coming years. Strategic foresight and adaptability will be key to navigating the challenges and opportunities ahead in the post-election environment.