Key Takeaways

- Private banks and wealth managers should reach out proactively, helping clients weigh short-term versus long-term risks.

- Community banks need to stay in close contact with clients to monitor interest coverage ratios and future financing needs.

- Commercial lenders and trade finance teams must account for elevated credit risk and growing insurance demands due to potential shipment delays and inventory issues.

- Investment banks will need to gauge deal viability and adjust deal fee forecasting.

- Prime brokerage desks in sales and trading should sharpen their attention to market risk and liquidity challenges.

Written by

Falguni Desai - Senior Strategy Advisor, Banking & Capital Markets, Microsoft

Jim Fuhrman - Senior Director, Banking Team, IBISWorld

Trade disruptions are becoming harder to predict—and banks are on the front lines of helping business clients stay ahead. As economic conditions shift, consistent and clear communication becomes critical to maintaining trust and stability. By guiding clients through uncertainty, banks can reinforce their role as strategic partners. But proactive planning looks different across the organization, from personalized support in Private Banking to risk management at scale in Global Markets.

Private banking & wealth management

The megatrend of a growing affluent and wealth management market remains true. Wealth management firms and wealth divisions of large banks still remain strong businesses given their recurring fee base. There is still a growing base of wealthy clients who need advice and the shock of tariffs may be an opportunity for these businesses to pick up new clients or new inflows as investors look for guidance and planning. Big macro events provide a reason for advisors to reach out to dormant clients, revisit financial plans and budgets and look at potential new investment products if market volatility persists.

Community banking

With roughly 1 small business for every 10 Americans, Community Bankers bear an outsized responsibility to support the domestic economy. Especially considering that many local business owners will not employ a board of directors, they will look to their banker as the center of influence to help them make the next strategic financial decision. With tariffs in play, and cash flow being squeezed, community bankers have the opportunity to provide more personalized service than their larger peers to support businesses through shakeups across their supply chains, which could include everything from advising a client to move their supply chain domestically, to financing a new facility through the reshoring of operations.

Community banks should be prepared to conduct more thorough credit reviews and monitoring as clients begin to see both P&L and balance sheet impact from higher tariffs. The biggest opportunity for community bankers is communication through these confusing times, particularly with small business owners who are likely already serving multiple responsibilities to their business and might not have the time to digest tariff news as it’s released.

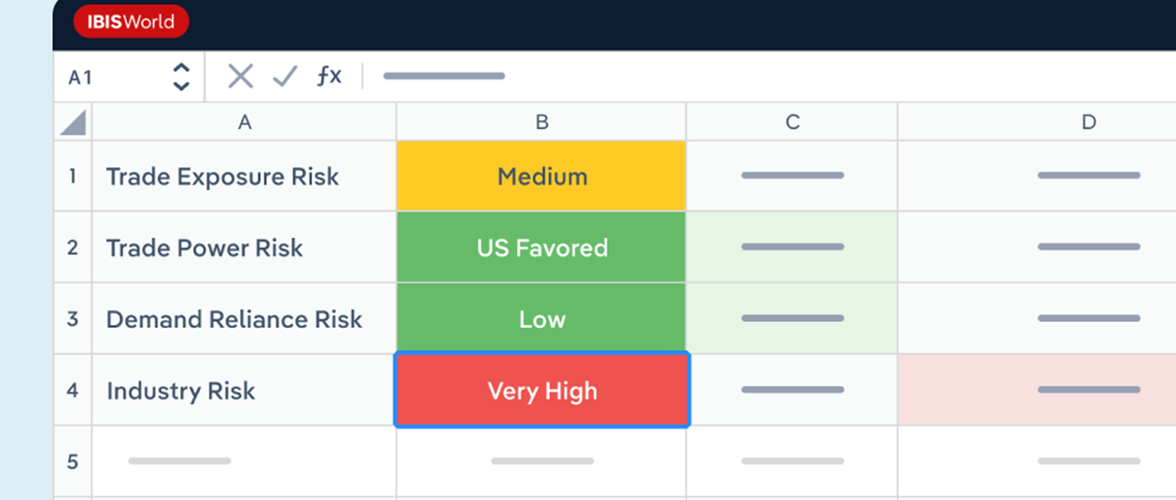

Commercial lending & trade finance

Lenders may find opportunity in working capital loans to support businesses affected by increased costs from their suppliers. However, these opportunities may not come easy, as uncertain times can paralyze borrowing sentiment. Manufacturers and Wholesalers will dominate the headlines for direct tariff considerations, but the trickle-down will be felt by most businesses – and each need a tailored approach. What’s important for bankers is to demonstrate their industry knowledge to each customer – showcasing where cashflows may be impacted by the tariffs, and then planning a path to remedy the constraints.

While lines of credit may be safe during the 90-day pause, lenders may want to consider special covenants on upcoming loans that consider that lack of clarity in the tariff rollout. Deploying the resources generally available to higher-ticket lending teams, lenders should demonstrate to clients their internal partnerships with treasury management to convey confidence in the full scope of solutions that address financing as well as the movement of their revenue streams.

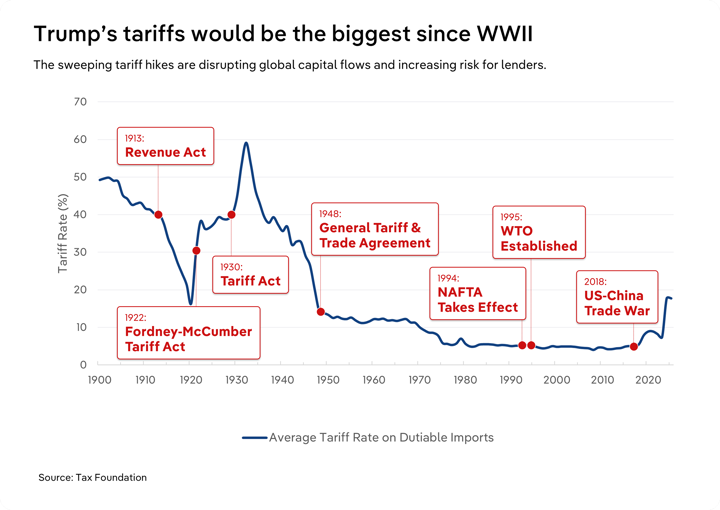

The most direct impact from higher tariffs will be to the supply chain and its financiers. While the intent behind the tariffs is to encourage more domestic U.S. production, in most cases, bringing a manufacturing plant or assembly line back onshore requires months if not years, meaning that imports will continue to come in, with everybody in the supply chain bearing greater costs due to the tariffs.

However, if foreign companies look to re-route and find alternatives to buying certain goods from the U.S., this will dent the revenues of U.S. based suppliers. The soybean crisis of 2018-2019 is an example of how American soybean farmers saw surpluses of their crops and a drop in prices, leading to working capital challenges and loan defaults.

Investment banking

2025 forecasts were rosy for these businesses of large global banks, and Q1 was healthy at 85 IPOs completed in the U.S., compared to 150 IPOs in all of 2024. But tariffs have dented expectations going forward. Those expectations included some highly anticipated, venture-backed fintech companies which have stayed private longer than in previous cycles. As of early April, companies have paused their roadshows and halted filings citing a volatile stock market. The Renaissance IPO Index was down over 25% YTD as of April 4.

Companies are hesitant to go public in markets that may not support valuation estimates, with weak buyside demand, or worse a steep decline in price shortly after going public. Similarly, M&A dealmaking for mega deals is likely to pause, as CEOs rethink big strategic moves and fully digest the impact tariffs may have on a target’s growth forecast. In response, bulge bracket banks have already trimmed their investment banking workforces by several hundred workers in the last quarter, but this could go leaner if volatility persists. Investment banks have always recalibrated their teams based on deal flow with junior bankers becoming the elastic band, most likely to be trimmed first and also overworked if market conditions become more deal friendly later in the year.

Sales & trading in global markets

Trading desks will be the beneficiaries of tariff induced volatility. While tariffs lead to declining stock and asset prices, they also generate volatility. As of early April, the VIX, (CBOE Volatility Index), a popular measure of the stock market's expectation of volatility based on S&P 500 index options, rose to over 50 points, substantially higher than the average 15-20, and the highest since the pandemic in March 2020.

Volatility is a key barometer that drives higher trading volumes, especially among hedge funds and high frequency traders. U.S. cash equities trading volumes have seen double digital percentage growth over the previous year in Q1. Agency trading desks are likely to see continued high volumes, thus driving higher than typical commission revenues. However, this volatility presents a double-edged sword. Big spikes in stock prices could result in portfolio losses that invoke margin calls, thus creating focus on market and credit risk for prime broker desks that lend to buyside clients.

About the authors

Falguni Desai, Senior Strategy Advisor, Banking & Capital Markets, Microsoft Corporation

As a corporate strategy leader, Falguni has over 25 years of global strategy experience in the banking, trading and financial market data space.

At Microsoft, she serves some of the largest financial institutions on Wall Street in their transformation, innovation and growth plays. She works with C-suite leaders to build business cases that drive revenue growth and efficiency, as they look to implement automation, software, artificial intelligence and cloud computing. Her focus is on business outcomes where technology can be an enabler.

Falguni was most recently at Credit Suisse, where she was the Global Head of Strategy & Transformation for Equities Technology within the Investment Banking Division. Prior to this, Falguni was the Managing Director of Strategy & Growth at BDO. Falguni spent over a decade at Thomson Reuters in several global business strategy and corporate development roles. Falguni started her career as an M&A investment banker at Paribas and consultant at Deloitte, and IBM.

As an active author and speaker, she has written over 50 articles for Forbes on topics ranging from fintech, financial services, corporate strategy and innovation. Her work has been cited in over 20 media outlets including, The New York Times, The Los Angeles Times, South China Morning Post, Business Insider, TechCrunch, and several other media outlets. Falguni holds a BS in Economics from The Wharton School of the University of Pennsylvania.

Jim Fuhrman, Senior Director, Commercial Banking, IBISWorld

A seasoned professional with over a decade of experience in fostering client relationships and delivering actionable insights within the financial services sector. Jim has built a career centered on empowering banking institutions with data-driven strategies, a mission he continues to champion at IBISWorld. His expertise lies in understanding the intricate dynamics of the commercial banking landscape, where he guides clients through economic shifts, regulatory changes, and evolving consumer behaviors.

Jim’s industry discussions emphasize the importance of macroeconomic trends in shaping banking strategies. He has a keen ability to distill complex data into practical solutions, helping banks identify growth opportunities and mitigate risks. His insights into banking trends highlight his forward-thinking approach, focusing on digital transformation, sustainability, and the rising demand for personalized financial services. Jim advocates for a client-centric mindset, encouraging banks to prioritize tailored solutions that deepen customer loyalty and grow wallet share.

With a passion for connecting macro-level insights to on-the-ground execution, Jim is a frequent speaker and collaborator. He has appeared on the American Bankers Association podcast, and has collaborated on dozens of articles and webinars with banking industry leaders across North America, offering takeaways on navigating competitive pressures and leveraging market intelligence.

Final Word

For many banks, we expect a “wait & see” over the next 90 days. But there will come a time in the near future where banks will need to make hard decisions and take control of an uncertain environment. Excluded from this group in regards to the divisions outlined above, are trading businesses, where high trading volumes and volatility are likely to remain the norm, creating a heightened focus on market and liquidity risk. But for companies that had strategic expansion plans, M&A, or an IPO planned, after a certain time threshold, the pause becomes a “delete” or a “go,” as a perpetual pause becomes untenable.