Key Takeaways

- US tariffs are disrupting Canadian trade, driving up costs and straining key industries like steel, automotive and agriculture.

- Economic uncertainty is weakening investor confidence and threatening long-term growth across Canada.

- Businesses can reduce exposure by diversifying supply chains, leveraging industry research and investing in resilience strategies.

The return of Donald Trump to the US presidency in late 2024 has once again brought trade policy into the spotlight, with significant implications for Canada. Just four months into his administration, the rollout of broad tariffs on a range of goods has disrupted years of relatively steady cross-border trade between the two nations. This resurgence of protectionism has sparked widespread concern among Canadian businesses, policymakers and consumers.

Canada’s economy is deeply intertwined with that of the United States, with bilateral trade accounting for nearly 20% of Canada’s GDP. The imposition of tariffs on key Canadian exports and imports threatens to unravel this economic interdependence, raising costs, complicating supply chains and injecting uncertainty into investment decisions.

Early signs of strain are already visible—supply chain delays, rising input costs and growing investor hesitancy all point to the potentially far-reaching ripple effects of US tariff policies. These dynamics are shaping Canada’s political and economic landscape, influencing domestic industries and creating new challenges for organizations. Navigating this complex trade environment calls for renewed strategies and informed decision-making.

US-Canada relations in the aftermath of tariffs

The Trump administration’s tariff policies are rooted in a protectionist agenda aimed at revitalizing American manufacturing and reducing trade deficits. By imposing tariffs on steel, aluminum, automotive parts and other goods, the administration seeks to shield US industries from foreign competition, particularly from China and, increasingly, Canada.

This approach reflects a broader shift away from multilateral trade agreements toward bilateral deals and unilateral measures. The tariffs are intended to pressure trading partners into renegotiating terms perceived as unfavorable to the US, but they also risk alienating key allies like Canada.

Canada’s political leadership has responded assertively to renewed trade tensions with the United States in 2025, following the imposition of tariffs on Canadian goods and energy by the Trump administration. Prime Minister Mark Carney—a former central bank governor whose economic credentials lend authority to his approach—has publicly condemned these tariffs as unjustified and harmful to both economies. His government has continued Canada’s engagement with the World Trade Organization (WTO) and utilized the dispute settlement provisions of the Canada-United States-Mexico Agreement (CUSMA) in an effort to uphold rules-based international trade. Alongside these diplomatic avenues, Carney has announced targeted retaliatory tariffs against select U.S. products to defend Canadian economic interests and signal Canada’s resolve.

Provincial leaders have also weighed in, with premiers from resource-rich provinces such as Alberta and Saskatchewan calling for stronger federal action to protect their industries. These provinces, heavily reliant on exports of steel, aluminum and agricultural products, have been particularly vocal about the economic damage caused by tariffs. Carney’s government has introduced liquidity measures, tax deferrals and targeted financing to help businesses in these provinces weather the trade disruption.

Moreover, the tariffs have intensified debates about economic sovereignty, referring to how much control Canada has over its own economy and Canada’s dependence on the US market. Business associations, including the Canadian Chamber of Commerce, are stressing that job number one must be to protect Canada’s economic sovereignty and security, warning that the proposed 25% tariffs could reduce Canada’s GDP by 2.6%, costing households an average of $1,900 per year. This has led to renewed calls for building a more resilient Canadian economy, including strengthening internal trade, improving trade infrastructure and reforming tax and regulatory policies, to reduce vulnerabilities and reliance on the US market.

2025 Canadian election

Trade tensions with the United States became the defining issue of Canada’s 2025 federal election, as President Trump’s sweeping new tariffs—particularly 25% duties on key Canadian exports like energy and autos—triggered a political and economic crisis. Trump's subsequent threats to annex Canada further outraged the Canadian public, fueling a surge in nationalism and dramatically reshaping the election's trajectory.

Prime Minister Mark Carney's Liberal Party emerged victorious in the April 28 election, securing the most seats in Parliament and completing a stunning political comeback. While final results were still pending due to uncounted special ballots, the Liberals were leading or elected in 168 ridings—just four short of a majority—when counting was paused. The Conservatives’ defeat delivered a strong rebuke of the Trump administration’s tariff policy and the rhetoric Pierre Poilievre had so closely aligned himself with.

All major parties had placed trade at the center of their campaigns, offering competing visions for how to protect Canada’s economic sovereignty. The Liberals and Conservatives endorsed retaliatory tariffs and support for affected workers, while the NDP and Greens advocated for even stronger measures and international coordination. But Carney’s message of resilience, unity, and economic protectionism resonated most deeply with voters rattled by Trump’s provocations.

With a Liberal victory, Carney has the leverage to respond to U.S. trade tensions with a strong, unified mandate for his policies: continuing robust retaliatory tariffs, investing in trade diversification, supporting affected industries and leveraging Canada’s international alliances to defend economic sovereignty. This outcome gives Carney the parliamentary backing needed to pursue an assertive response to U.S. tariffs and further his agenda of protecting Canadian industries while reducing reliance on the U.S. market. Such an approach might provoke further backlash from President Trump, forcing Carney to weigh how best to manage an escalating cross-border relationship.

Canadian sectors most affected by US tariffs

The second Trump administration’s aggressive tariff policies are sending shockwaves across the Canadian economy. With new or expanded duties targeting key exports, industries that depend on smooth cross-border trade are under pressure. From resource-heavy sectors like steel and agriculture to advanced manufacturing and auto production, Canadian businesses are facing higher costs, supply chain disruptions and growing uncertainty—all of which threaten jobs, investment and long-term competitiveness.

Steel and aluminum

The imposition of a 25% tariff on Canadian steel and aluminum by the US, citing national security concerns under Section 232 of the Trade Expansion Act, has severely disrupted North American supply chains. Canadian steel and aluminum producers, heavily reliant on exports to the US, have endured significant challenges. Notably, these tariffs have increased production costs for Canadian mills, reduced demand and led to job losses. For example, hundreds of workers in steel and aluminum plants have been laid off, as companies struggle to absorb the financial burden of tariffs while maintaining operations.

The ripple effects extend beyond direct producers to industries that use steel and aluminum as inputs, such as construction and manufacturing. Higher costs for these materials are driving up prices for infrastructure projects, machinery and consumer goods like appliances and vehicles. Additionally, retaliatory measures by Canada—such as reciprocal tariffs on US steel and aluminum products—have further strained trade relations between the two nations.

To mitigate these impacts, Canadian producers are exploring alternative markets and negotiating lower input costs with suppliers. However, the lack of immediate substitutes for US buyers underscores the interconnectedness of North American supply chains, making these tariffs particularly damaging.

Automotive

The automotive sector is among the most vulnerable to tariff-induced disruptions due to its reliance on tightly integrated cross-border supply chains. Tariffs on imported parts and raw materials have increased production costs for Canadian manufacturers, threatening their competitiveness in global markets. The just-in-time manufacturing processes prevalent in the industry are especially susceptible to border delays caused by tariffs.

Retaliatory tariffs imposed by Canada on US-produced vehicles have added another layer of complexity. These measures specifically target cars that fail to meet content requirements under the United States-Mexico-Canada Agreement (USMCA), disproportionately affecting suppliers reliant on non-North American parts. The resulting uncertainty has prompted some automakers to delay investments or scale back operations in Canada.

Despite these challenges, there are potential silver linings for Canadian-built vehicles. By excluding certain auto parts from its tariffs, Canada has positioned itself to offer more competitively priced vehicles compared to American-made counterparts. However, this advantage may be offset by US incentives encouraging consumers to purchase domestically assembled cars .

Agriculture

Canadian farmers are experiencing both direct and indirect impacts from US tariff policies. Directly, tariffs on agricultural machinery and inputs like phosphate fertilizers sourced from the US have increased operational costs for farmers. Indirectly, retaliatory tariffs imposed by Canada on agricultural exports such as pork and pulses have reduced market access in the US, forcing producers to seek alternative buyers in Asia and Europe.

The agriculture sector’s reliance on cross-border trade makes it particularly sensitive to disruptions caused by tariffs. For instance, higher input costs are squeezing profit for farmers already facing tight budgets due to fluctuating commodity prices. Also, retaliatory measures risk alienating long-standing trading partners in the US, further complicating efforts to stabilize the sector.

Efforts to diversify export markets have yielded some success; pulse producers have expanded sales to India and China, partially offsetting losses in the US. However, these initiatives require significant investment in logistics and marketing infrastructure, which smaller producers may struggle to afford.

Manufacturing

Broader manufacturing sectors that depend on imported inputs from the US are grappling with cost pressures that threaten their competitiveness. Tariffs on raw materials like steel and aluminum have increased production expenses across industries ranging from machinery manufacturing to consumer goods production.

The impact extends beyond direct costs; manufacturers are also facing delays in supply chains due to border frictions exacerbated by tariffs. These disruptions complicate inventory management and production schedules, leading to inefficiencies that can further erode profit.

In response, some manufacturers are investing in automation and supply chain diversification strategies to reduce reliance on US-sourced inputs. However, these measures require substantial upfront capital, which may not be feasible for smaller firms operating with limited resources.

Layoffs within manufacturing sectors are becoming increasingly common as companies attempt to cut costs amid declining revenues. This trend underscores the broader economic fallout of tariff policies that prioritize short-term protectionism over long-term stability in North American trade relations.

Domestic economic fallout from US tariffs

The economic impact of US tariffs on Canada goes far beyond specific industries—it's rippling through the broader economy. Tariff-related costs and uncertainties are weighing on business confidence, slowing investment and straining supply chains. As Canada retaliates and attempts to adapt, the resulting disruptions are raising inflation risks, creating currency instability and threatening the country’s economic momentum.

Trade disruptions and retaliatory measures

Canada has responded with retaliatory tariffs on US goods, including steel, aluminum and agricultural products. While these measures aim to pressure the US to reconsider its policies, they also risk escalating trade tensions and further disrupting supply chains.

The uncertainty surrounding tariffs has led some Canadian exporters to seek alternative markets, but the US remains the dominant destination for Canadian goods. The disruption of this trade relationship threatens to slow economic growth and reduce export revenues.

Supply chain pressures

Tariffs and border frictions have increased costs and caused delays in supply chains. Companies face higher prices for imported inputs and longer wait times at the border, complicating inventory management and production schedules. These disruptions are particularly acute in industries with tightly integrated North American supply chains, such as automotive and electronics manufacturing.

Inflationary risks

Higher import costs due to tariffs contribute to inflationary pressures in Canada. The Bank of Canada has noted that tariffs on steel, aluminum and other goods are pushing up prices for construction materials, machinery and consumer products. This inflation erodes purchasing power and may prompt tighter monetary policy, further slowing economic growth.

Currency volatility

The Canadian dollar has experienced increased volatility amid tariff uncertainty. Since late September 2024, the loonie has depreciated by nearly 6% against the US dollar. While a weaker Canadian dollar can make exports more competitive, it also raises the cost of imported goods, exacerbating inflationary pressures.

Investor confidence and capital investment

Trade uncertainty has dampened investor confidence. Businesses are delaying capital expenditures and expansion plans due to unpredictable tariff policies and the risk of escalating trade conflicts. This hesitation threatens to slow innovation and productivity growth in key sectors.

Cross-border uncertainty, in particular, compounds these effects by increasing the complexity of forecasting future returns on investment. When multinational firms cannot predict regulatory environments, taxes or market access, they are less likely to commit to large-scale projects or enter new markets. This uncertainty often leads companies to preserve cash, reduce hiring and suspend research and development initiatives. As a result, immediate investment often stalls and longer-term corporate expansion strategies may be shelved until policies stabilize.

Strategies for navigating tariff complexities

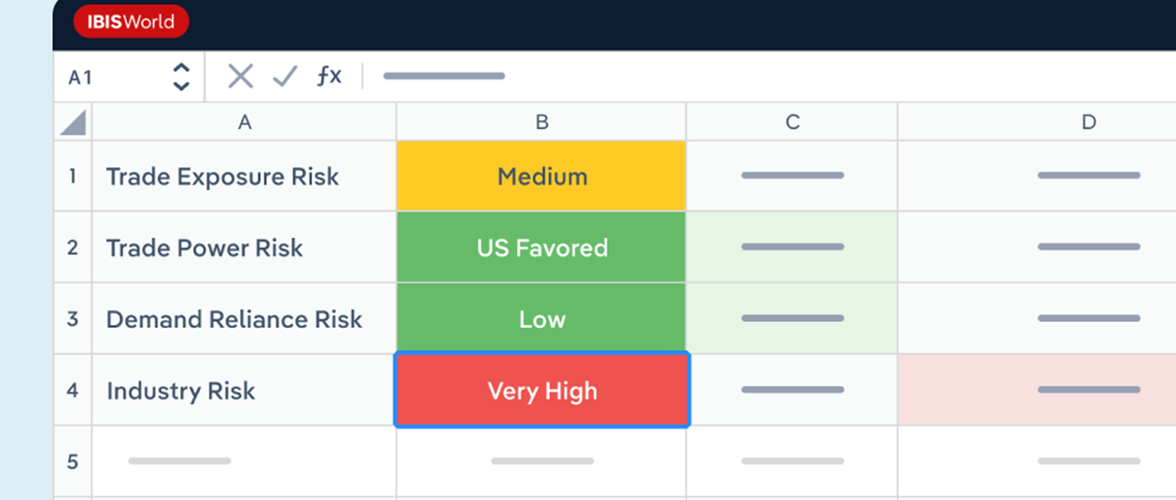

- Use Canadian industry research to assess exposure and benchmark performance: Detailed market analysis helps identify how tariffs impact specific sectors, uncover vulnerabilities in supply chains and highlight areas for strategic growth.

- Diversify supply chains and reduce reliance on the US market: Expanding sourcing options to include domestic or international partners can help mitigate risks. Exploring new export markets under trade agreements like CETA and CPTPP also reduces dependence on the US.

- Strengthen pricing strategies and control rising costs: Businesses can use dynamic pricing, cost control initiatives and efficiency improvements to absorb tariff-related expenses without eroding customer trust or profitability.

- Invest in technology and automation for greater resilience: Automation and digital tools can minimize disruption from supply chain delays and reduce reliance on labor-intensive processes, enabling quicker responses to market shifts.

- Stay informed and engage in trade advocacy: Monitoring policy developments and participating in industry associations helps businesses anticipate changes and advocate for policies that support Canadian economic interests.

Final Word

The resurgence of US tariffs under the Trump administration has introduced significant challenges for the Canadian economy. From disrupted supply chains and rising costs to inflationary pressures and weakened investor confidence, the ripple effects are broad and complex. Canadian industries face a landscape marked by uncertainty and the need for strategic adaptation. By leveraging detailed industry analysis, diversifying supply chains and markets and adopting flexible operational strategies, Canadian businesses can better confront these challenges.