Key Takeaways

- South-East Asia plays a critical role in Australia’s supply chains, but rising US tariffs may reshape trade routes and expose hidden vulnerabilities.

- Vietnam’s reliance on US exports makes it highly exposed, with Australian consumer goods retailers facing potential supply chain disruption and rising costs.

- Thailand’s automotive and machinery sectors are key pressure points, posing risks for Australian motor vehicle dealers and opportunities in raw material exports.

- Other regional players like Malaysia, Singapore and Taiwan are less exposed, but Australian firms should still prepare for indirect shocks and adjust sourcing strategies.

Growing trade tensions in South-East Asia, driven by the universal tariffs imposed by the United States, are set to have a seismic impact on regional economies that are deeply integrated into global supply chains. While President Trump has enforced a 90-day relief period on tariffs, capping it at 10% for most countries, high levels of uncertainty remain around what the future is going to look like once this period concludes in July. This uncertainty has been exacerbated by the recent agreement between China and the United States to reduce reciprocal tariffs to 10% for 90 days, beginning on May 14th.

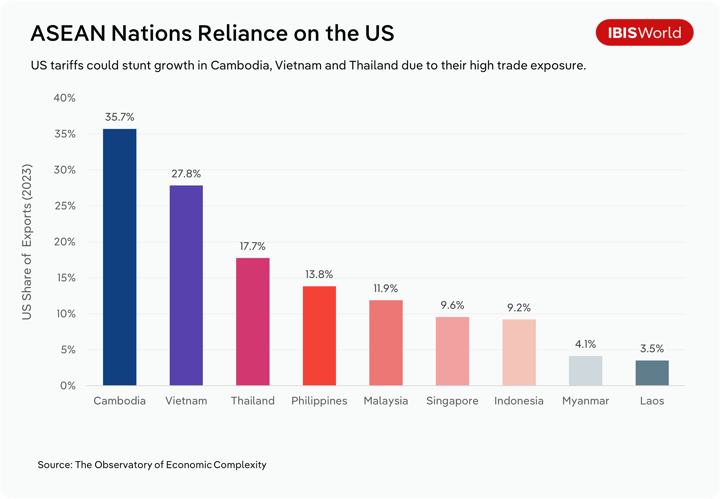

Low-GDP per capita countries in South-East Asia stand to be some of the hardest hit by President Trump’s ‘reciprocal’ tariffs, with Cambodia (49% tariff on exports to the United States), Vietnam (46%), Thailand (36%) and Malaysia (24%) among the worst off under the initial tariff structure unveiled on April 2nd.

These potential escalations of US tariffs on the region threaten to destabilise long-term economic development models that have driven growth in the region over the past two decades.

Despite being some of the hardest hit countries by America’s tariffs, Vietnam and Thailand’s economies are particularly exposed, as their export-driven GDP growth model is under threat. In 2023, Vietnam accounted for 4.0% of US imports, equating to $118 billion USD or 27.8% of the country's total exports, while Thailand accounted for 1.9% of US imports, equating to $56.6 billion USD or 17.7% of its total exports.

While Malaysia is slightly less exposed, the United States still accounted for 11.9% of the country’s total exports in 2023, causing fear of the impact tariffs might have on trade revenue and GDP growth. These South-East Asian economies that rely on large trade surpluses with the United States must now seek to reduce their reliance on the US market while still maintaining profitability.

Trade tensions in South-East Asia represent not only a geopolitical shift, but also a business issue for Australian businesses sourcing goods from the area. Tariffs are likely to result in a drop in aggregate demand for products, leading to closures of low-margin manufacturing facilities. Australian businesses may be forced to pay up to source goods from the area, as their economies of scale deteriorate, forcing them to charge higher prices to remaining customers.

The relevance of South-East Asia

South-East Asia plays a vital part in global trade routes due to its geographic advantage as a bridging route between the Pacific and Indian Oceans, positioning it as a prime hub for worldwide trading. This geographical competitive advantage causes South-East Asia to be highly integrated among the world’s global value chains (GVCs), with over 60% of the region’s exports connected to these networks.

Yet, integration levels vary across the region. Low-GDP per capita countries, like Vietnam and Thailand, are most often involved through backward linkages, where businesses import foreign inputs for use in their own exports. These countries are known as major global manufacturing hubs, attracting foreign direct investment (FDI) from developed economies, especially in electronics and commodities. However, with some of the highest tariffs set to be imposed on low-GDP South-East Asian nations, FDI from the United States is likely to dry up, as more businesses look to reshore manufacturing operations closer to home.

US trade actions are set to have a significant impact on trade routes and the Australian supply chain. With more manufacturing activity occurring in the United States, transport costs for many businesses are set to increase, as Australian businesses lose access to the shorter trade routes offered by Asian trade partners. Production costs are also likely to grow, as labour and material costs expand in the production chain.

China’s expanding role

While the United States-China 90-day reduction in reciprocal tariffs will provide some relief to Chinese exporters, President Trump hasn’t been shy in being vocal about his desire to reduce the United States’ reliance on China as a trade partner. As a result, China is likely to increase its reliance on local trading partners in the ASEAN region in the near future.

As a result, South-East Asian countries are set to expand their alignment with China in their GVCs, capitalising on the hole left in the world’s second-largest economy. This will create a growing dilemma for Australian policymakers, as they will need to play Switzerland and balance geopolitical tensions between the United States and China without necessarily prioritising either nation.

Australia’s trade relationship with China has been anything but smooth over the past five years, after Beijing imposed restrictions on key Australian exports in response to political disputes in 2020, impacting wine production, coal mining and seafood processing exports. While the relationship has stabilised somewhat in recent years, uncertainties remain due to ongoing geopolitical tensions and Australia’s efforts to reduce reliance on China and strengthen ties with other trade partners.

Australia’s reliance on the region

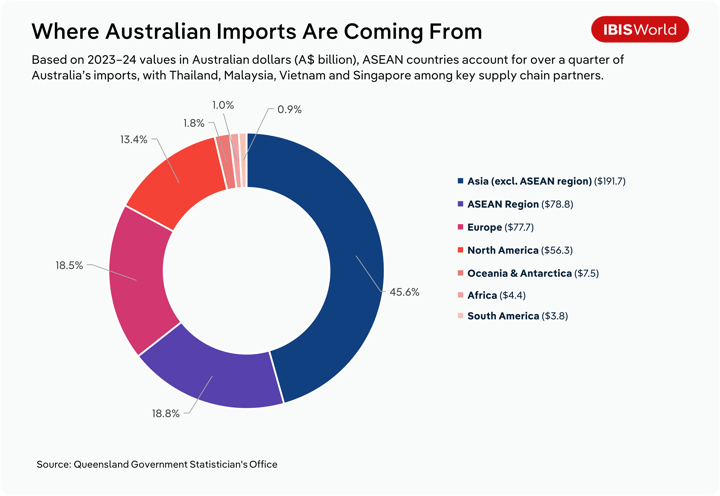

South-East Asia holds particular significance for the Australian economy, as its proximity makes it a major player in Australia's supply chain network. This strength has been supported by the Regional Comprehensive Economic Partnership that came into force in 2022, providing free trade relations for Australia with 14 countries throughout South-East Asia, including Thailand, Vietnam and Indonesia.

This partnership has solidified South-East Asia as a significant source of raw materials, consumer goods and components for Australian businesses, as well as being a crucial market for Australian exports of resources and agricultural products. However, with questions being posed about GDP growth across the region, Australian businesses exporting to the region are likely to witness slowdowns in export demand growth, driving the need to diversify and find new trade partners or solidify agreements with current import markets.

However, Australia’s reliance on South-East Asia is set to come under scrutiny as the dynamics of global trade and Australia’s supply chain network face unrest, as US tariffs shock the global trade market. While its geographic competitive advantage will remain, the strategic role of South-East Asian trade partners could evolve, presenting both opportunities and challenges for Australian businesses.

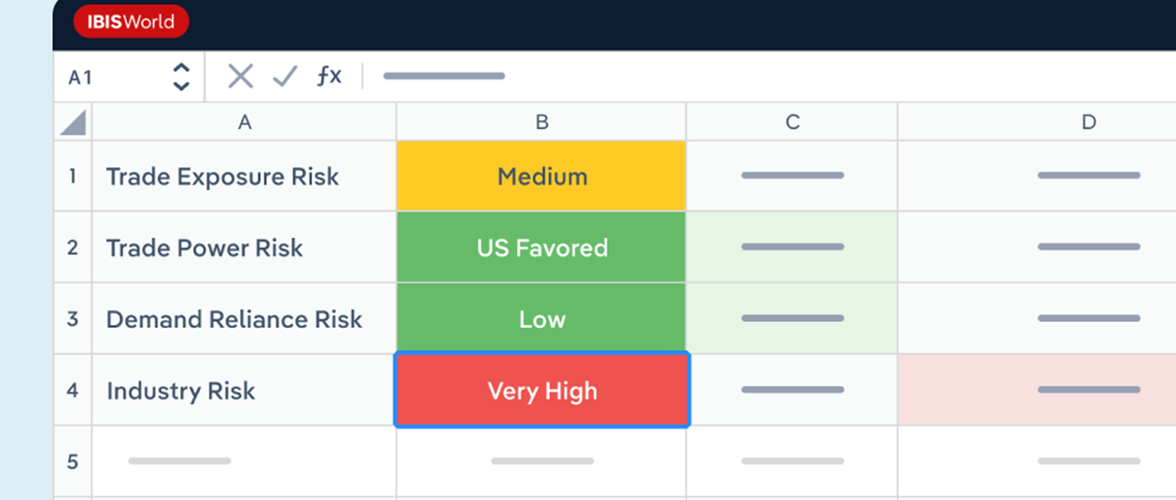

How vulnerable are low-GDP, trade-reliant economies?

Australia's supply chain is intricately linked with various South-East Asian countries. While Australia’s manufacturing sector has its own strengths, many companies engage in overseas manufacturing to supplement local operations and take advantage of lower costs and favourable business environments. As a result, Australia is highly reliant on imports from the area.

Australia’s three largest import trade partners in Asia are China, Japan and South Korea. However, even excluding these three countries, the rest of Asia still accounts for over 26% of Australia’s total goods imports. That’s why tariff-related stress on some of our major trade partners could have a significant impact on local businesses, as costs are passed down the supply chain.

Vietnam

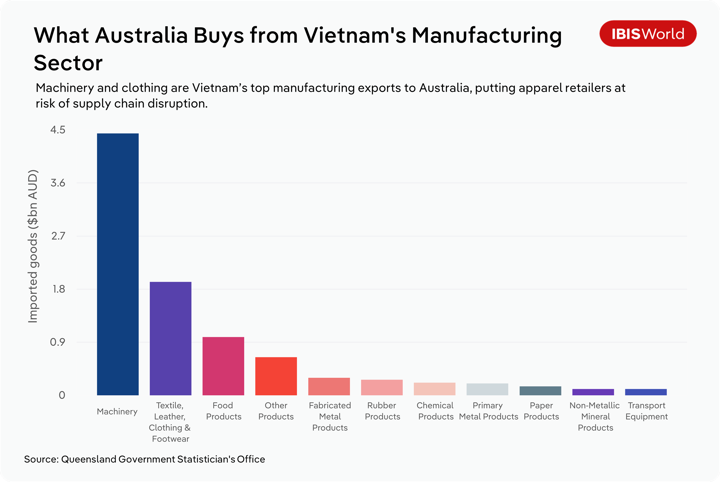

Vietnam’s vulnerability to US tariffs is evidenced by the country’s reliance on exports for GDP growth. Its trade surplus of over $100.0 billion USD with the US, which equates to more than a quarter of the country’s GDP, will come under threat, with the machinery and textiles sectors the most exposed.

While Vietnam will be pushed to increase their alignment and reliance on China as a trade partner, its competitive advantage will be eroded, as the Chinese machinery and textiles manufacturing sectors are relatively self-sufficient.

Vietnam is the 8th largest exporter to Australia, accounting for 2.6% ($10.9 billion AUD) of imports in 2023-24. Specifically, Australian Consumer Goods Retailing industries, like Sport and Camping Equipment Retailing and Clothing Retailing, are set to be the most heavily impacted by potential supply chain complexities.

Scale benefits for manufacturers are likely to be eroded. These facilities will be unable to maintain profit margins without increasing prices. While this may seem counterintuitive, given demand falls generally insinuate price declines, import costs are likely to climb as Vietnamese manufacturers scramble to maintain profitability.

High tariffs on Vietnam can also provide opportunities for Australian firms to step in. Vietnam’s seafood exports to the United States measured at just under $1.0 billion USD in 2023, a sector where Australia’s competitive advantage may provide growth opportunities for businesses in the Seafood Processing industry. By engaging with businesses that have historically relied on an inflow of goods from Vietnam, Australian companies can patch a hole in the supply chain while leveraging our geographical advantage for seafood production. However, whether these opportunities are long-run sustainable or short-term shocks will be determined by the ability of respective governments to engage in trade negotiations with the United States to minimise volatility in tariff policy impacts stemming from the White House.

Here’s how Australian businesses can respond to rising costs and shifting supply routes:

Pass down costs

As Australian retailers are the most heavily linked to Vietnam in the supply chain, passing down cost increases to consumers will be imperative to ensure profit margins don’t deteriorate. Businesses may also need to adjust product ranges or sourcing decisions to soften the impact, while clearly communicating price changes to maintain customer trust.

Explore new trade routes and opportunities

While tariffs on Vietnam will drive increased production in the US, the comparative advantage offered to Australian exporters with relatively low tariffs can provide an opportunity to expand exports into the US.

Australian importers may also need to explore new trade routes. With growing optimism about an AU-EU free trade deal that would push down procurement costs for medicinal products and motor vehicles, Australian businesses could explore this avenue, leveraging the security of Europe’s developed economies.

Thailand

Thailand’s scale of reliance on US exports is less than Vietnam’s, as the country’s exports are more diversified. Despite this, the country still relies on an annual trade surplus measuring over $30.0 billion USD in 2023. Some of the key sectors exposed to US tariffs include machinery manufacturing, rubber and plastic products and motor vehicles, in particular motorbikes.

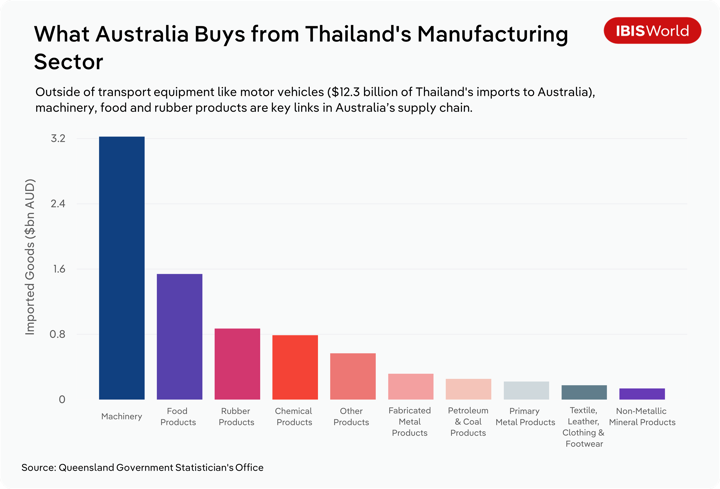

Automobile manufacturing has been an area of focus for President Trump, with his tariffs aiming to renew strong manufacturing output within the United States. This is likely to have the greatest impact on Australian Motor Vehicle Dealers, with $11.6 billion AUD worth of motor vehicles coming from Thailand in 2023-24, making it the second largest exporter behind Japan. Instability in Australia’s motor vehicle supply chain is likely to put upwards pressure on car prices, particularly for manufacturers with operations in Thailand like Ford, Mazda and Isuzu.

High tariffs, initially set at 36% for Thai exports, will also erode competitive advantage for machinery that accounts for a large share of trade between the two countries. While this will provide opportunities for other nations, like Japan and South Korea, to potentially increase their machinery exports to the United States, Australia may have a trump card up its sleeve.

Australian natural resources, particularly Iron and Aluminium, may be able to fill a void in the supply chain for machinery manufacturers in the United States, while leveraging its 10% tariff and allowing US businesses to avoid tariffs of over 20% on Japanese and South Korean products.

Australian businesses can take several steps to reduce exposure and build resilience:

Thorough market research

Australian businesses will need to conduct extensive market research to understand the risks and opportunities presented by trade route shifts. Studying market trends, political stability, economic situation, cultural aspects and legal structure will allow them to make informed decisions about potential threats and opportunities.

Diversification of investment

It's important not to put all eggs in one basket. Australian companies will need to diversify their supply chain across multiple markets to minimise potential risks. Having investments in diverse sectors can prevent significant loss in the case of sudden supply chain bottlenecks or trade route breakdowns.

Regional exposure beyond Vietnam and Thailand

While other countries in South-East Asia export a large share of goods to the United States, dependence on this trade route is less vital to their economies. Countries like Singapore (9.6% of exports go to US), Taiwan (16.5%) and Malaysia (11.9%) have more diversified trade profiles, making them better positioned to absorb disruptions than economies Vietnam and Thailand. However, these countries won’t be immune to supply chain shocks, meaning Australian businesses with trade networks in the area need to stay aware of the changing landscape.

Here’s how Australian businesses with broader ties across South-East Asia can stay resilient amid shifting trade dynamics:

Strengthen supply chain visibility and flexibility

In order to cope better with potential trade route shocks, Australian businesses should ensure that they have a comprehensive understanding of their supply chains, especially with South-East Asian partners. Businesses should be able to answer the question, ‘If our supply chain faces cost growth, can we identify the source and what will be our plan of action?’.

This versatility can prove crucial in times of sudden trade shifts. They can consider exploring alternative supply options from different geographic regions that are less impacted by the US tariffs. Regions like the United Kingdom, which recently bartered a free-trade agreement with the United States, could offer an area for Australian businesses to explore, despite the proximity challenges this trade route offers.

Consider long-term procurement contracts

Given that tariff changes can introduce uncertainty about the future, Australian businesses may want to consider locking in their operational costs by opting for long-term procurement contracts with their South-East Asian suppliers. By locking in demand and prices, businesses can hedge against potential tariff-induced price fluctuations. This also has the added benefit of building a stronger, more resilient relationship with suppliers, who may then be more likely to prioritise their Australian partners should a trade shock occur.

Final Word

The impending US tariffs on South-East Asia are poised to reshape trade dynamics within the region and beyond, with Australian businesses anticipated to face repercussions due to their supply chain and sourcing ties to the ASEAN region.

Particularly vulnerable industries like consumer goods retailers and automotive dealerships, which heavily rely on imports from nations like Vietnam and Thailand, will be forced to assess their exposure, forge strong local partnerships, diversify their investments and consider reassessing their trade routes in this rapidly changing global trade economy.