Key Takeaways

- IBISWorld’s US Trade Tariff Exposure Tool—now freely available for all US industry subscribers—helps businesses quickly identify tariff-related risks and cost drivers across their operations.

- Teams in supply chain, strategy, and investment functions use the tool to proactively respond to shifting trade policies.

- From procurement to underwriting, the tool supports smarter decisions that protect margins and uncover new opportunities.

As global trade tensions rise and the threat of new tariffs looms, businesses are once again grappling with uncertainty. In recent months, escalating tariff disputes with key US trading partners—including Canada, China, Mexico, and the EU—have intensified significantly, leading to rapid and unpredictable changes in tariff rates and the range of affected goods. With further tariff escalations increasingly likely, companies across every sector are confronting an urgent and critical question: how exposed are we to tariffs?

Unfortunately, answering that question isn’t straightforward. Trade data is often fragmented, technical, and difficult to translate into real business impact. While some firms rely on customs brokers or consultants to piece together tariff exposure, most teams lack a fast, reliable way to quantify the risk across their supplier and customer base. That’s where we come in.

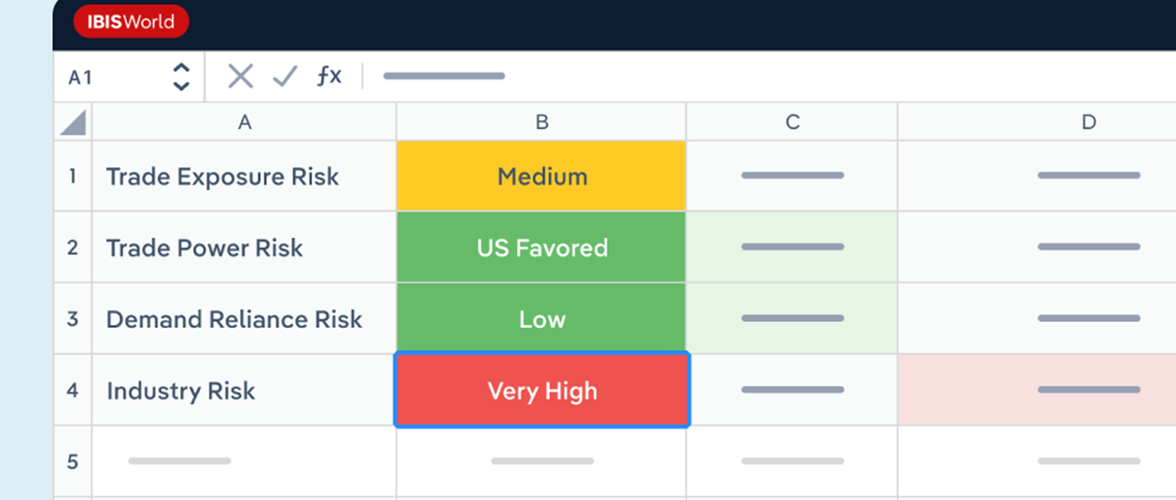

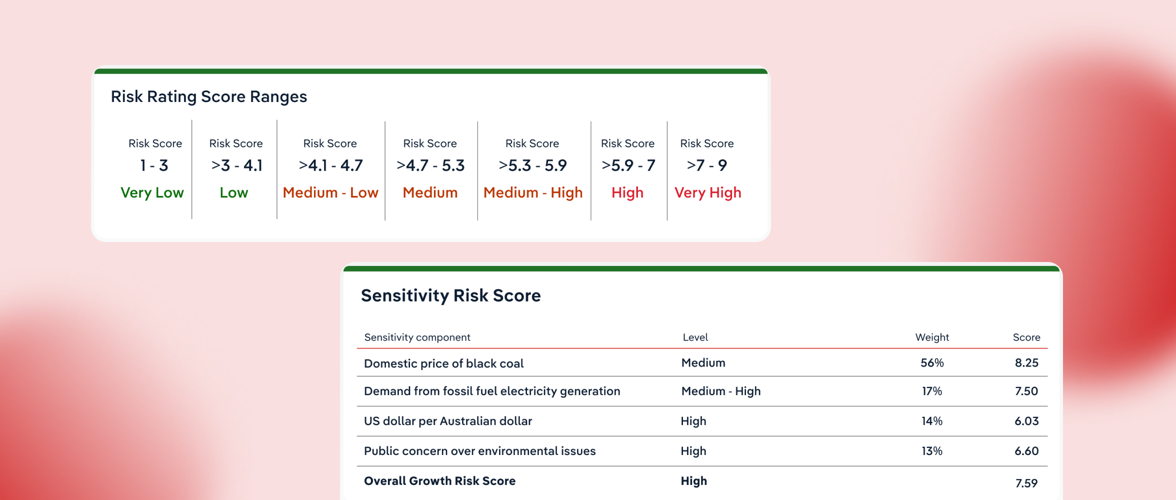

IBISWorld’s new US Trade Tariff Exposure Tool gives you instant visibility into how tariffs may affect your industry. Built using a proprietary mapping of NAICS codes to the Harmonized Tariff Schedule (HTS), the tool allows you to quickly identify which imported products are most relevant to your sector—and whether they’re currently subject to tariffs or proposed measures. With access to comprehensive tariff and trade data, you can cut through the complexity and assess tariff-related risk with clarity and confidence.

How to use the US Trade Tariff Exposure Tool

The tariff exposure tool was created to help IBISWorld’s clients stay informed of the evolving trade landscape between the US and its trading partners.

Watch this brief video overview highlighting how to navigate data in this tool effectively:

Three strategic ways to use tariff intelligence

Whether you're navigating supply chain disruptions, assessing market risks, or weighing investment opportunities, understanding tariff exposure is essential. This tool supports teams across the business by bringing clarity to trade-related vulnerabilities—helping supply chain managers build resilience, strategy leaders plan with confidence, and investment teams make more informed decisions.

Here are a few ways that IBISWorld clients are maximizing the power of comprehensive tariff data.

1. Minimize disruption and maximize visibility in your supply chain

For supply chain leaders, tariff changes can quickly ripple across sourcing strategies, inventory management, and cost structures. The US Trade Tariff Exposure Tool gives you a detailed, product-level view of where these risks lie—so you can act before disruptions occur. By leveraging Harmonized System (HS) codes in the 2.0 version, the tool connects your specific products directly to the relevant US import tariffs, clearly highlighting which inputs are most vulnerable and pinpointing areas where costs are likely to increase.

Supply chain and procurement teams can use the tool to:

- Quickly identify high-risk inputs (such as semiconductors, raw metals, or automotive components) that are subject to significant tariffs.

- Trace tariff vulnerabilities back to specific trading partners or sourcing regions.

- Evaluate alternative suppliers or markets less exposed to tariff fluctuations.

- Proactively renegotiate supplier agreements or adjust contract terms based on expected tariff impacts.

- Optimize inventory management decisions—such as where to store inventory or timing shipments strategically—to minimize cost volatility.

This level of granularity allows for a comprehensive assessment of tariff risk across your supplier base. The tool’s coverage of more than 1,000 US industries and over 200 trading partner countries helps you rapidly spot vulnerabilities across regions and plan for alternative sourcing arrangements. Ultimately, the US Trade Tariff Exposure Tool gives you the visibility and confidence to maintain operational continuity, control expenses, and strengthen your supply chain against sudden shocks.

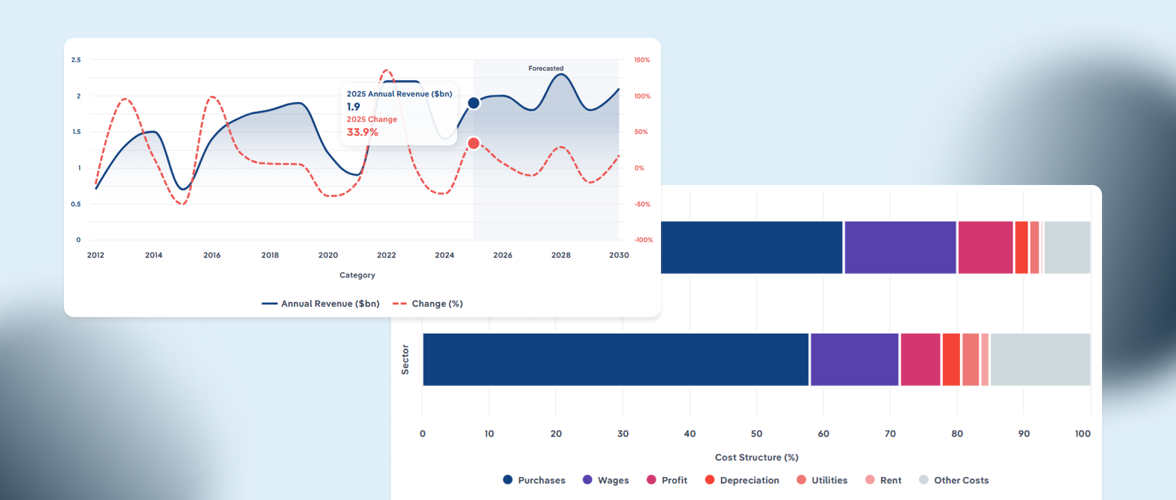

2. Strengthen strategic planning with a clear view of tariff exposure

For strategic planners—whether in accounting, auditing, M&A advisory, or corporate development—the ability to quantify tariff risk is crucial for evaluating business resilience and growth potential. The Trade Tariff Exposure Tool provides data-driven clarity into which products, inputs, and industries are most impacted by current US import duties. This helps strategic decision-makers clearly assess exposure across clients, portfolios, or internal operations.

Strategic planning teams leverage the tool to:

- Demonstrate a company’s limited exposure to high-tariff inputs during sell-side M&A advisory engagements, strengthening valuations and addressing buyer concerns.

- Identify industries where strong domestic demand could offset international revenue risks, improving strategic positioning.

- Anticipate rising costs of goods sold (COGS) in tariff-sensitive industries, allowing auditors and financial advisors to proactively manage conversations around expected profit margins.

- Use HS-code-level granularity to transparently communicate how reliant a business is on specific tariff-affected trade flows.

- Evaluate structural tariff sensitivity to assess pricing power, domestic insulation, and competitive advantage in shifting global trade conditions.

By surfacing strategic insights clearly and transparently, the tool empowers businesses and advisors to anticipate headwinds, uncover overlooked opportunities, and build smarter, more resilient growth strategies.

3. Inform smarter investment and capital decisions with tariff insights

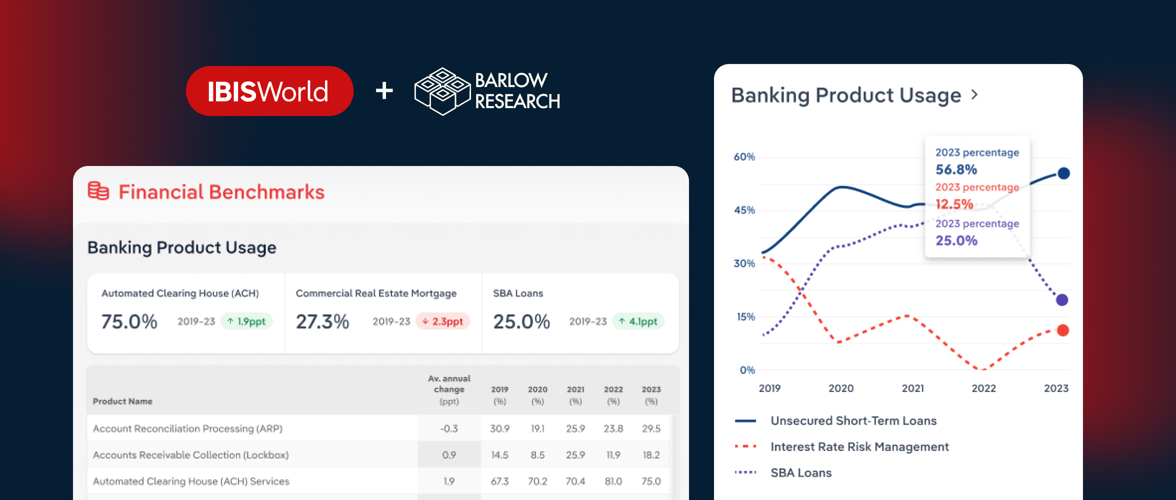

For financial professionals tasked with evaluating risk—whether through underwriting insurance policies, issuing loans, or managing investment portfolios—tariff exposure has become an increasingly important factor in capital allocation. With global trade conditions shifting and protective tariffs on the rise, lenders and insurers are under increased pressure to understand how vulnerable their clients and counterparties are to cost increases and margin compression.

Financial teams use the Trade Tariff Exposure Tool to:

- Assess how exposed a borrower’s operations are to sudden tariff-induced cost shocks, enabling smarter credit risk evaluations.

- Pinpoint tariff-driven cost pressures at the HS code level to determine whether viable domestic sourcing alternatives exist for at-risk businesses.

- Support insurance underwriting by clearly identifying operational vulnerabilities, improving risk modeling for commercial property, casualty, or business interruption policies.

- Inform long-term investment strategies by assessing which businesses or industries have strong pricing power, supply chain agility, or domestic market strength to withstand shifting tariff environments.

- Allocate capital more effectively by understanding and mitigating tariff-related downside risks.

With trade dynamics shifting quickly—and with major financial consequences—the Trade Tariff Exposure Tool equips lenders, insurers, and investors with the detailed intelligence they need to confidently evaluate resilience, mitigate risks, and allocate capital strategically.

Final Word

Whether you're navigating sourcing decisions, advising clients on market positioning, or evaluating risk across lending and investment portfolios, the ability to see and respond to tariff exposure is now a competitive advantage. IBISWorld’s US Trade Tariff Exposure Tool equips teams with the detailed, product-level intelligence needed to make faster, smarter decisions in uncertain trade environments.

To see how the tool can support your workflows and unlock new strategic insights, request a demo today.